HELOC default is a serious issue that can have far-reaching consequences for homeowners. Many people underestimate the risks associated with defaulting on their Home Equity Line of Credit.

At HELOC360, we’ve seen firsthand how devastating the effects of HELOC default can be. In this post, we’ll explore the shocking consequences and provide practical advice to help you avoid this financial pitfall.

What Happens When You Default on a HELOC?

Understanding HELOC Default

HELOC default occurs when a borrower fails to make payments on their Home Equity Line of Credit as agreed. This can happen for various reasons, such as job loss, unexpected medical expenses, or poor financial management. Many homeowners underestimate the seriousness of HELOC default and its consequences.

The Mechanics of HELOC Default

When you default on a HELOC, you break the agreement you made with your lender. This typically happens after you miss several payments. However, this can vary depending on the lender and the terms of your agreement.

Common Reasons for HELOC Default

Financial hardship stands as the primary cause of HELOC defaults. Unexpected life events often trigger these situations. Job loss, divorce, or major medical expenses can quickly drain savings and make it difficult to keep up with payments.

HELOC Default vs. Other Loans

HELOC default is particularly risky because your home serves as collateral. Unlike credit card debt or personal loans, defaulting on a HELOC puts your home at risk of foreclosure.

Moreover, HELOCs often have variable interest rates. This means that as rates rise, your payments can increase, making it even harder to catch up if you fall behind. The average HELOC rate is 7.99% as of May 7, 2025, according to recent forecasts.

The Importance of Early Action

If you struggle with HELOC payments, you must act quickly. Many lenders offer hardship programs or modification options, but these work best when initiated early.

Homeowners should stay proactive and communicate with their lenders at the first sign of financial trouble. Understanding the potential risks and taking early action can help you protect your home and financial future.

What Happens Right After HELOC Default?

Your Credit Score Plummets

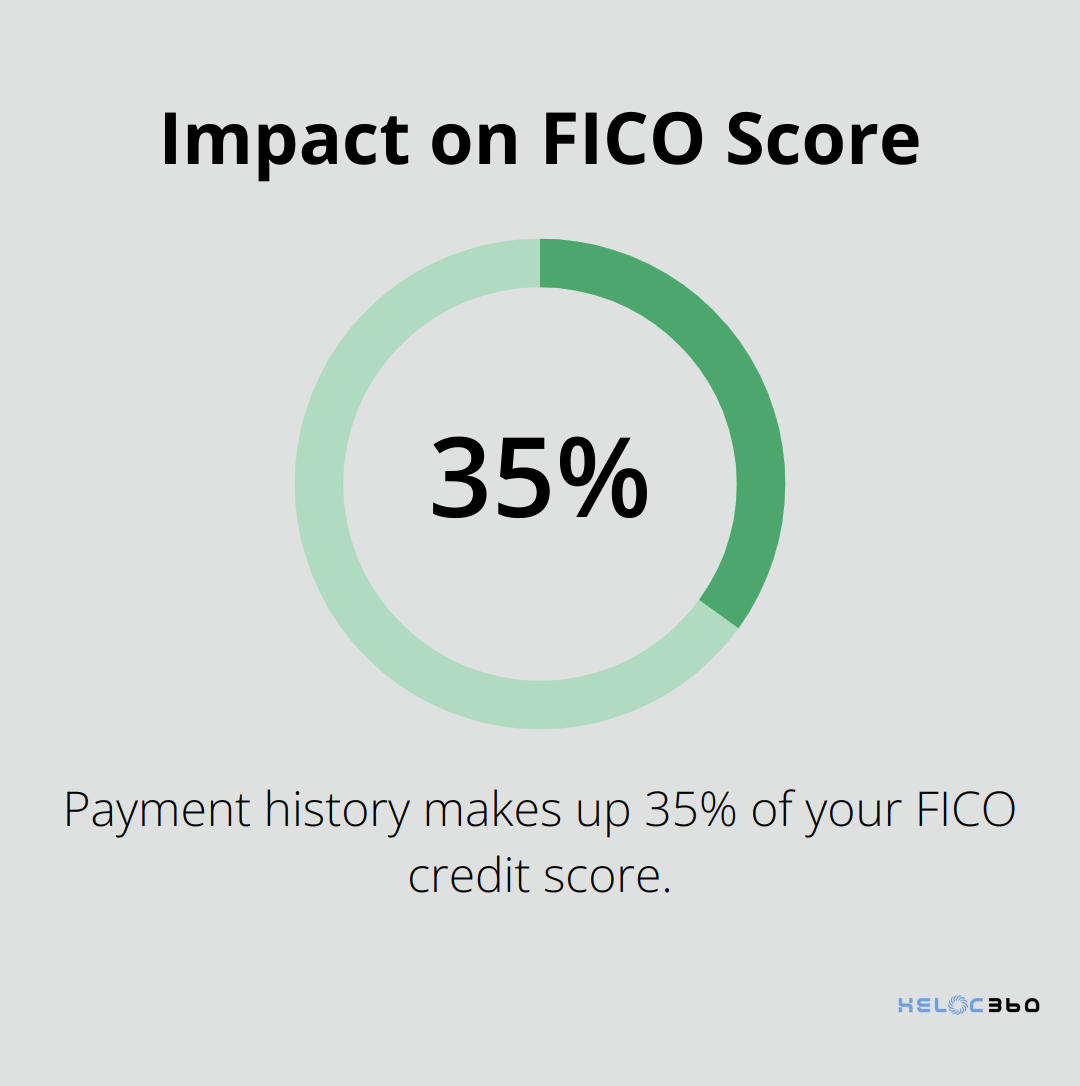

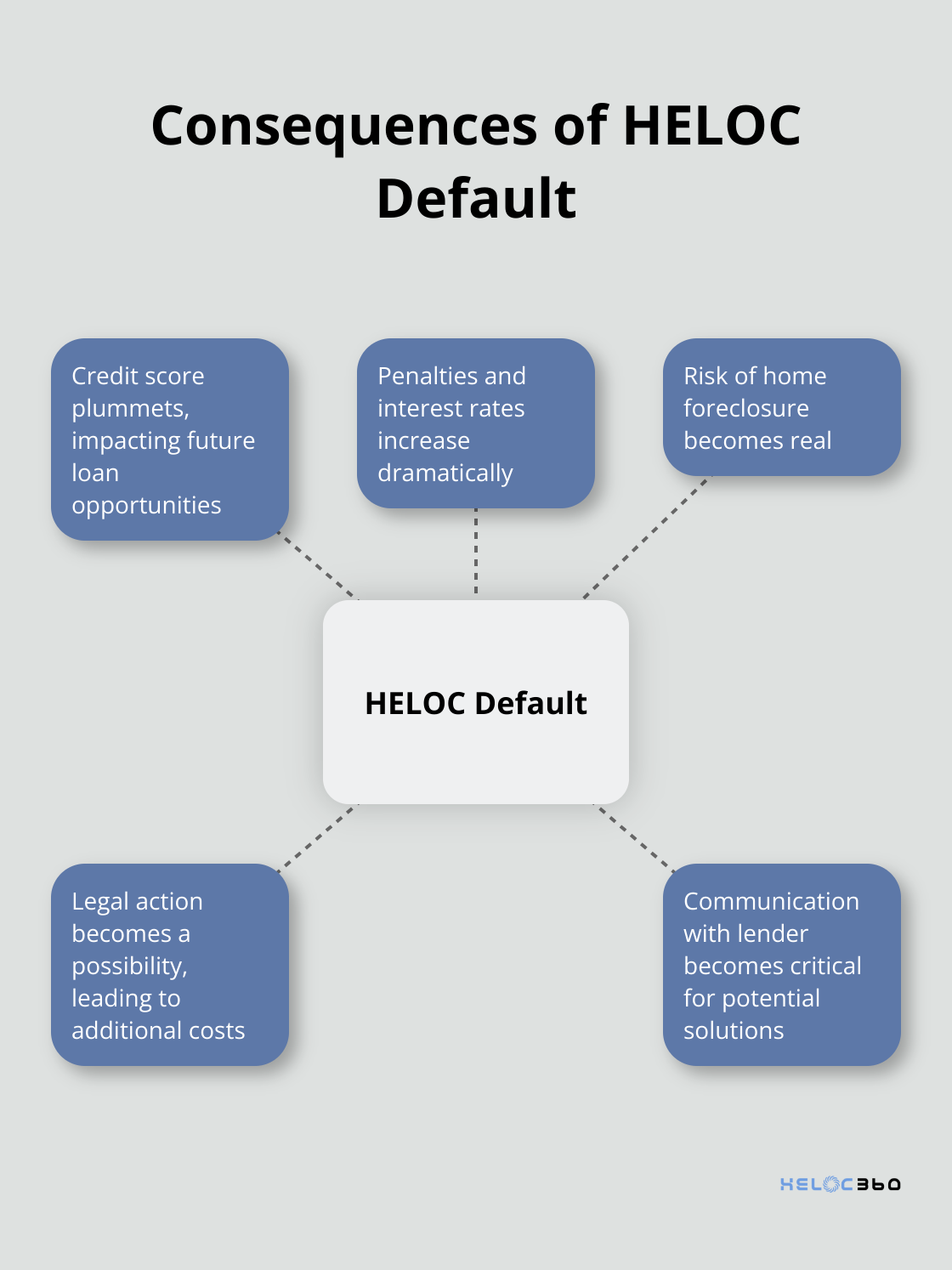

When you default on your HELOC, it can impact your credit score. Payment history accounts for 35% of your FICO score (according to myFICO). A default appears on your credit report and stays there for up to seven years, which makes it difficult to secure future loans or credit.

Penalties and Interest Rates Increase Dramatically

Lenders respond to defaults with hefty penalties and increased interest rates. Late fees can be significant. For example, if your monthly mortgage payment is $2,200, a 5 percent late fee equals $110. Your interest rate might jump to the maximum allowed by law (up to 29.99% in some states). This sudden increase can cause your debt to spiral out of control quickly.

The Risk of Foreclosure Becomes Real

The most alarming consequence of HELOC default is the potential loss of your home. Your house serves as collateral for the HELOC, which gives lenders the right to start foreclosure proceedings.

Communication with Your Lender Becomes Critical

If you face difficulty with HELOC payments, you should contact your lender immediately. Many lenders offer hardship programs that can help you avoid default and its severe consequences. Open communication can lead to potential solutions such as payment plans or loan modifications.

Legal Action Becomes a Possibility

Defaulting on your HELOC can lead to legal action from your lender. They might sue you to recover the outstanding balance, which can result in wage garnishment or liens on your other assets. This legal process can be costly and time-consuming, adding further stress to an already difficult situation.

The immediate consequences of HELOC default are severe and far-reaching. However, the long-term effects can be equally devastating. Let’s explore how a HELOC default can impact your financial future beyond these initial repercussions.

The Long Shadow of HELOC Default

A Tarnished Financial Reputation

Getting a HELOC can affect your credit score, but the extent and direction of the impact depend on how you manage it. Experian, one of the major credit bureaus, reports that a single missed payment can lower your credit score by up to 110 points. This drop makes it extremely challenging to secure future loans or credit cards. Lenders view HELOC defaults as a major red flag, often leading to automatic rejection of loan applications.

Even if you secure a loan, you’ll likely face much higher interest rates. The Federal Reserve Bank of New York found that borrowers with poor credit scores pay interest rates that are 3 to 5 percentage points higher than those with excellent credit. Over the life of a loan, this difference can cost you tens of thousands of dollars.

Legal Battles and Financial Drain

Lenders don’t simply write off defaulted HELOCs. They often pursue legal action to recover their losses. This can result in wage garnishment, where a portion of your income is automatically deducted to repay the debt. Wage garnishment lets creditors take money from your paycheck or bank account to pay a debt, usually the result of a court judgment.

Legal proceedings are costly and time-consuming. You might need to hire an attorney, which the National Association of Consumer Advocates estimates can cost between $100 and $500 per hour. These expenses, combined with potential court fees, can quickly deplete your savings and worsen your financial situation.

Career and Housing Hurdles

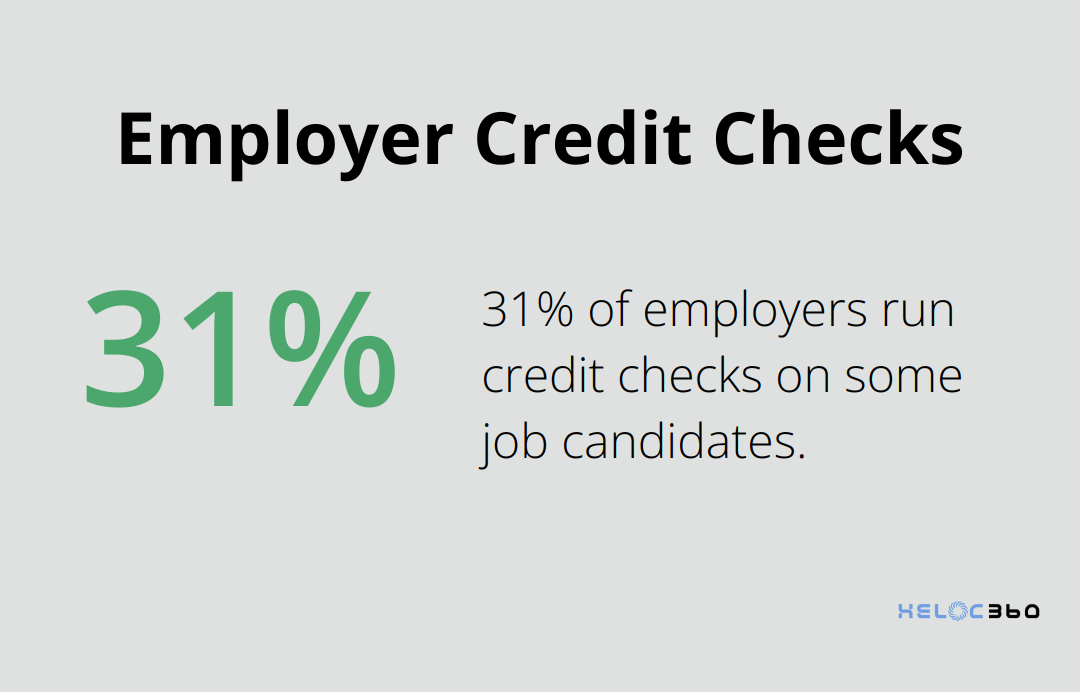

The impact of a HELOC default extends beyond your finances. Many employers conduct credit checks as part of their hiring process. A survey by the National Association of Professional Background Screeners found that 31% of employers run credit checks on some candidates. A default on your record could cost you job opportunities, especially in finance-related fields.

Finding housing also becomes more challenging. Landlords often check credit reports when screening tenants. A HELOC default might lead to rejected rental applications or requirements for larger security deposits. Landlords want tenants who pay rent on time, so they often run a credit check in the screening process. It doesn’t show your rental history.

Long-Term Financial Implications

The effects of a HELOC default can persist for years. Your credit report will show the default for up to seven years, affecting your ability to obtain new credit or favorable terms on loans. This can impact major life decisions, such as buying a car, starting a business, or purchasing a new home.

Moreover, the financial stress caused by a default can lead to other issues. A study by the American Psychological Association found that 72% of Americans feel stressed about money at least some of the time. This stress can affect your mental health, relationships, and overall quality of life.

Final Thoughts

HELOC default carries severe consequences that can impact your financial future for years. The immediate effects include credit score damage, increased interest rates, and the risk of home foreclosure. Long-term repercussions involve difficulties obtaining future loans, potential legal action from lenders, and obstacles in employment and housing opportunities.

We at HELOC360 understand the complexities of managing a Home Equity Line of Credit. Our platform helps homeowners make informed decisions about their home equity. We provide expert guidance and connect you with lenders that fit your unique financial situation.

You can protect your home and financial future by managing your HELOC responsibly and seeking help when needed. Don’t let HELOC default derail your dreams. Take control of your financial health today by leveraging our resources to understand your options better and potentially avoid the pitfalls that lead to default.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.