Getting turned down for a HELOC can be frustrating, but it’s not the end of the road.

At HELOC360, we understand the disappointment that comes with a HELOC denial. However, there are steps you can take to improve your chances of approval in the future.

This guide will walk you through understanding why you were denied, how to enhance your financial profile, and what alternative options you might consider.

Why Was Your HELOC Application Rejected?

Low Credit Score: A Common Culprit

A low credit score often leads to HELOC rejections. Experian’s recent study revealed that the average FICO® Score among HELOC borrowers in most states is close to 800. Lenders might view you as a high-risk borrower if your score falls below 700.

To address this issue:

- Get your free credit report from AnnualCreditReport.com

- Check for errors and dispute inaccuracies with credit bureaus

- Pay bills on time and reduce credit card balances

These steps will help improve your financial profile over time.

High Debt-to-Income Ratio: A Red Flag for Lenders

Lenders scrutinize your debt-to-income (DTI) ratio when evaluating HELOC applications. Most home equity lenders look for a DTI ratio of no more than 43 percent. Calculate your DTI by dividing your monthly debt payments by your gross monthly income.

If your DTI is too high:

- Pay down existing debts

- Find ways to increase your income

Even a small reduction in your DTI can significantly boost your chances of HELOC approval.

Insufficient Home Equity: The Foundation of HELOCs

HELOCs rely on your home’s equity. Most lenders require you to maintain a minimum of 20 percent equity. You may face denial if your home’s value has decreased or you haven’t built up enough equity.

To increase your home equity:

- Wait for your home’s value to appreciate (if market conditions allow)

- Make extra mortgage payments

- Consider home improvements to increase property value

The Importance of Your Denial Letter

Your HELOC denial letter contains valuable information about why your application failed. Don’t ignore it – read it carefully. The letter should outline specific reasons for the denial and may suggest steps to improve your application.

If the letter lacks detail, contact the lender directly. Ask for a comprehensive explanation of the factors that led to your rejection. This information will serve as a roadmap for addressing issues and strengthening future applications.

Understanding these common rejection reasons will help you take targeted action to improve your financial profile. In the next section, we’ll explore strategies to enhance your creditworthiness and increase your chances of HELOC approval.

How to Boost Your HELOC Approval Odds

Supercharge Your Credit Score

Your credit score plays a pivotal role in HELOC approvals. HELOCs can be a good option if you have solid credit and enough equity, but they also have drawbacks and aren’t a great fit for every situation. To elevate your score:

- Pay all bills punctually. Automatic payments can help you avoid late fees.

- Lower credit card balances. Try to keep your credit utilization ratio under 30%.

- Limit new credit applications. Each hard inquiry can reduce your score by up to 5 points.

- Maintain old accounts. Credit history length accounts for 15% of your FICO Score.

Slash Your Debt-to-Income Ratio

Lenders typically prefer a debt-to-income (DTI) ratio below 43%. To reduce your DTI:

- Tackle high-interest debts first. This debt avalanche method saves money on interest.

- Use a balance transfer credit card with a 0% introductory APR to consolidate and pay off debt faster.

- Boost your income through side gigs or requesting a raise at work.

- Avoid new debt while you focus on improving your DTI.

Increase Your Home Equity

Most lenders require at least 20% equity in your home for HELOC approval. To boost your equity:

- Make additional mortgage payments. Even small extra payments accumulate over time.

- Invest in value-boosting home improvements.

- Allow for natural appreciation. Some markets experience rapid home value increases.

Improving your financial profile takes time and consistency. While you work on these enhancements, it’s worth exploring alternative financing options. Let’s examine some potential alternatives in the next section.

What Are Your Other Financing Options?

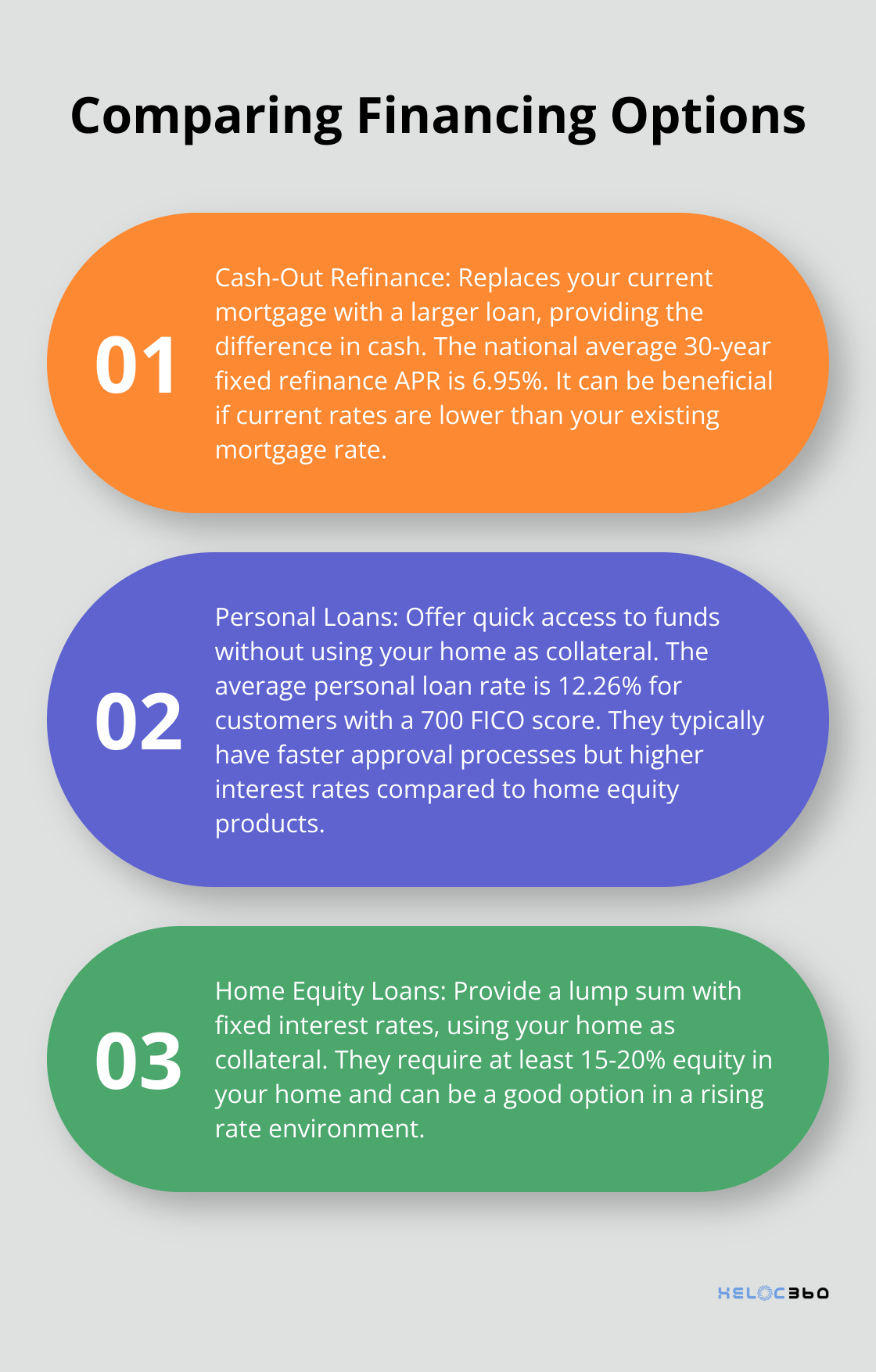

Cash-Out Refinance: Tap Into Your Home’s Value

A cash-out refinance replaces your current mortgage with a new, larger loan. You receive the difference between the new loan amount and your existing mortgage balance in cash. This option can attract homeowners if current interest rates fall below their existing mortgage rate.

The national average 30-year fixed refinance APR is 6.95%, according to Bankrate’s latest survey of the nation’s largest refinance lenders.

However, refinancing typically involves closing costs (2% to 5% of the loan amount). You must also consider the long-term impact of extending your mortgage term.

Personal Loans: Quick Access to Funds

Personal loans offer a way to borrow money without using your home as collateral. They typically have faster approval processes and funding times compared to home equity products.

The average personal loan rate is 12.26 percent for customers with a 700 FICO score, as of May 14, 2025. While this rate exceeds typical HELOC rates, personal loans can serve as a good option if you need funds quickly or prefer not to risk your home.

Most lenders cap personal loans at $50,000 or less, which results in smaller loan amounts compared to HELOCs or cash-out refinances.

Home Equity Loans: A Fixed-Rate Alternative

Home equity loans (often called second mortgages) provide a lump sum of money upfront. Unlike HELOCs, they typically offer fixed interest rates, which can benefit borrowers in a rising rate environment.

Home equity loans still use your home as collateral, so you’ll need sufficient equity and a strong credit profile to qualify. Most lenders require at least 15-20% equity in your home.

Exploring Your Options with HELOC360

While these alternatives can help, you must carefully consider your financial situation and goals before choosing a financing option. Each choice comes with its own set of pros and cons, and the best option depends on your specific circumstances.

If you feel unsure about which option fits your needs, HELOC360 can guide you through your home equity options. Our platform provides personalized recommendations based on your unique financial situation (without making any assumptions about your needs or preferences).

Final Thoughts

A HELOC denial doesn’t signal the end of your financial journey. It presents an opportunity to reassess your situation and take action to improve your financial health. You should review your denial letter carefully and contact the lender for more details if needed. This information will guide your efforts to enhance your creditworthiness.

You can boost your credit score by paying bills on time and reducing credit card balances. Work to lower your debt-to-income ratio by tackling high-interest debts and exploring ways to increase your income. Take steps to build more equity in your home through extra mortgage payments or value-boosting improvements (if possible).

Don’t overlook alternative financing options while you improve your financial profile. HELOC360 offers personalized guidance to help you navigate your home equity options. Our platform simplifies the process, providing you with the knowledge you need to make informed decisions about leveraging your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.