HELOC acceleration clauses can catch borrowers off guard, potentially leading to serious financial consequences. These provisions allow lenders to demand full repayment of the loan under certain circumstances.

At HELOC360, we believe understanding these clauses is essential for anyone considering a home equity line of credit. This post will explain what HELOC acceleration clauses are, how they impact borrowers, and steps you can take to protect yourself.

What Triggers a HELOC Acceleration Clause?

Understanding HELOC Acceleration

A HELOC acceleration clause empowers lenders to demand full repayment of the outstanding balance on a home equity line of credit under specific circumstances. This provision acts as a safeguard for lenders, allowing them to mitigate potential losses. According to the Consumer Financial Protection Bureau, “In general, a creditor may not change the terms of a plan after it is opened.”

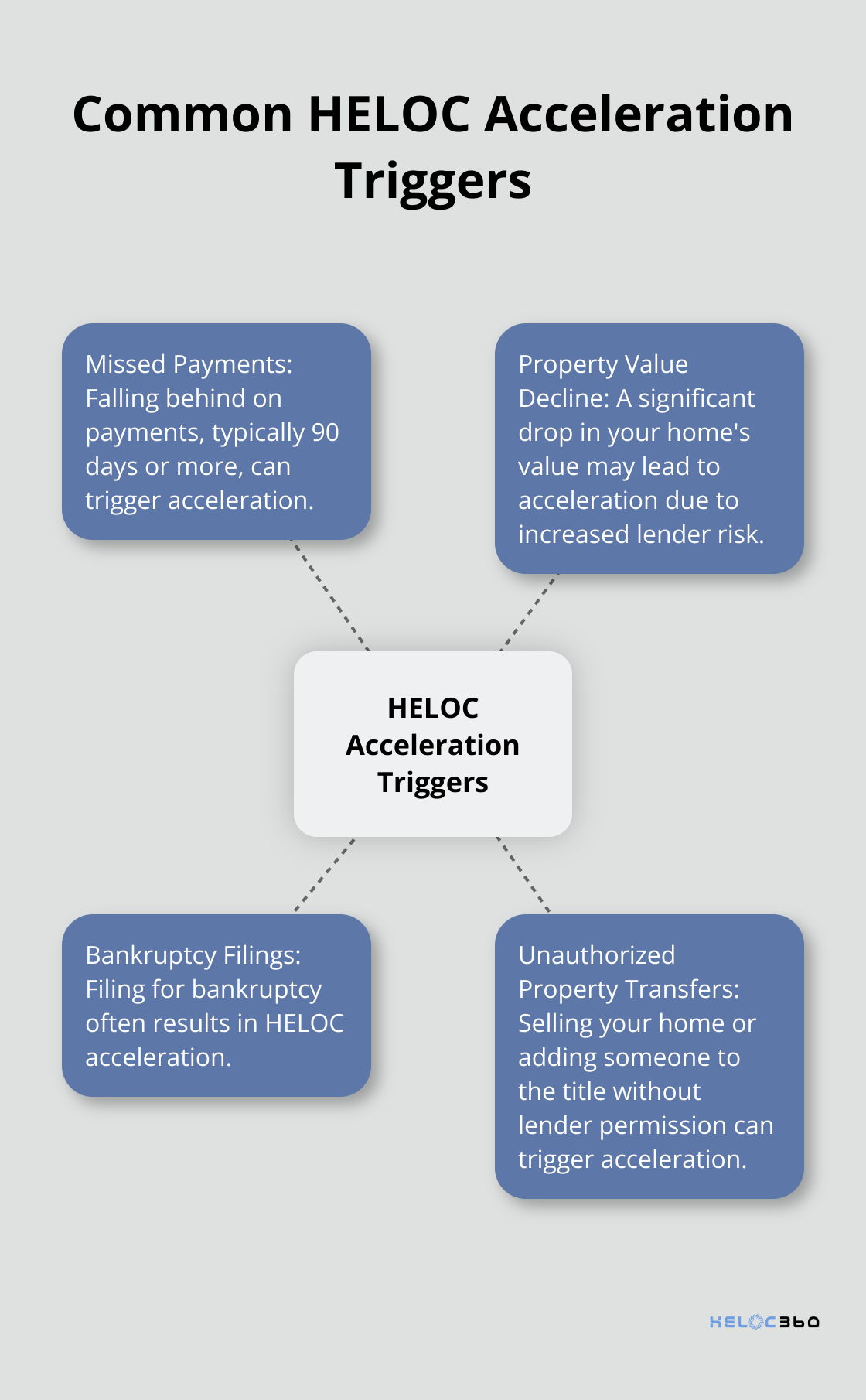

Common Acceleration Triggers

Missed Payments

Payment defaults top the list of acceleration triggers. Lenders typically wait until a borrower falls 90 days behind before they invoke this clause.

Property Value Decline

A substantial drop in your home’s value can trigger acceleration. Lenders view this as increased risk.

Less Common but Serious Triggers

Bankruptcy Filings

Filing for bankruptcy often leads to HELOC acceleration.

Unauthorized Property Transfers

Selling your home without the lender’s permission or adding someone to the title without notification can trigger acceleration. These actions violate the terms of most HELOC agreements.

Strategies to Avoid Acceleration

To steer clear of HELOC acceleration:

- Make timely payments (set up automatic payments or reminders)

- Communicate proactively with your lender about financial difficulties

- Maintain your property’s value through regular repairs and improvements

These steps not only protect you from acceleration but also help increase your home’s equity over time.

The complexities of HELOC acceleration clauses underscore the importance of understanding your loan terms thoroughly. In the next section, we’ll explore the impact of these clauses on borrowers and the potential consequences of default.

What Happens When a HELOC Accelerates?

Immediate Repayment Demand

When a HELOC acceleration clause activates, borrowers face an abrupt financial challenge. The entire outstanding balance becomes due immediately. For instance, if you have a $100,000 HELOC balance, you might need to produce that full amount within a short timeframe (often 30 to 60 days).

This sudden demand forces borrowers to make difficult financial decisions. Some options include:

- Liquidating investments

- Using retirement savings

- Considering home sale

Legal Consequences

Failure to repay the accelerated HELOC can lead to severe legal repercussions:

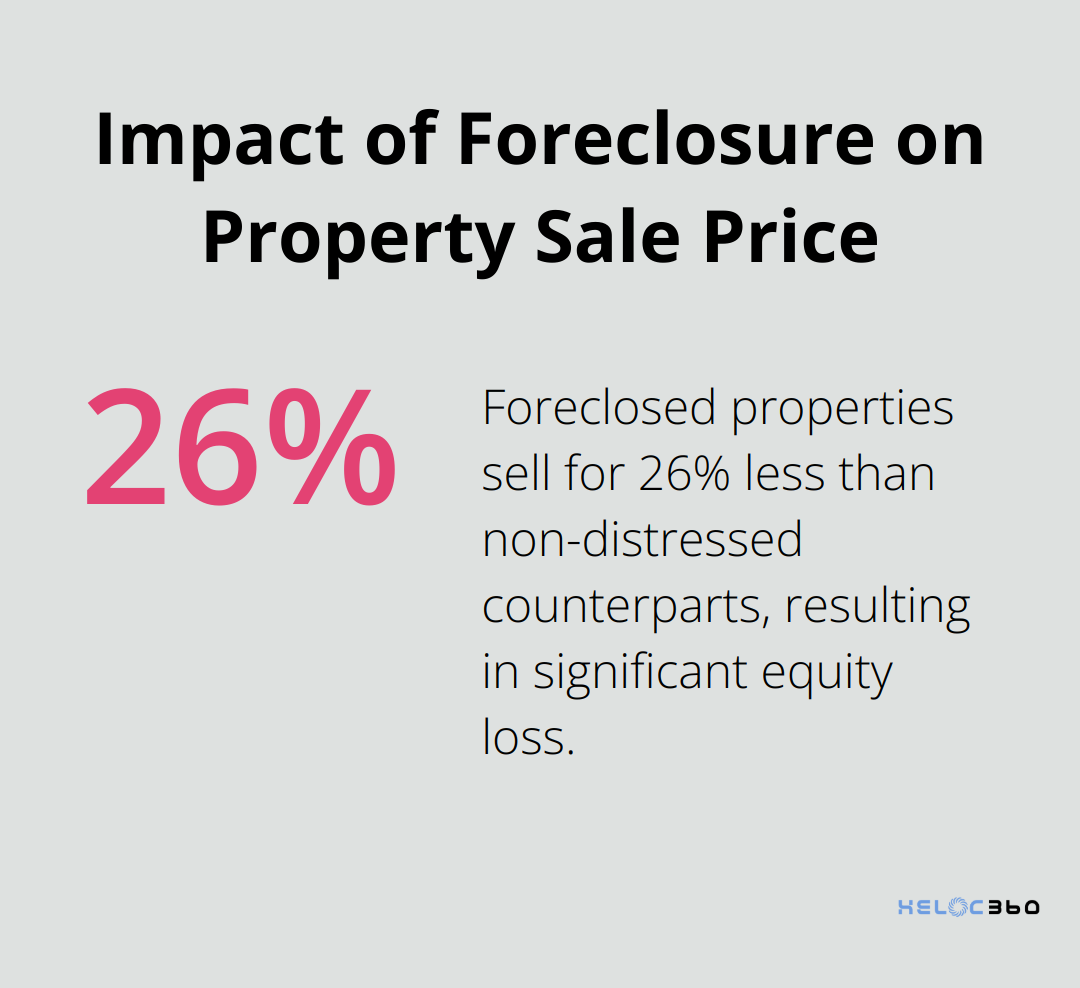

- Foreclosure Risk: Lenders may initiate foreclosure proceedings, putting your home at risk. According to RealtyTrac data, foreclosure sales sold for an average of 26% less than their non-distressed counterparts, potentially resulting in significant equity loss.

- Legal Action: Lenders might sue to recover the debt. This action could result in:

- Wage garnishment

- Liens on other assets you own

Credit Score Impact

HELOC acceleration extends beyond immediate financial strain, affecting your long-term creditworthiness:

- Credit Score Drop: A foreclosure can cause a significant decrease in your credit score. This decrease can persist for years.

- Future Borrowing Difficulties: Even if you avoid foreclosure, an accelerated HELOC on your credit report can make lenders cautious. You might face:

- Higher interest rates on future loans

- Challenges qualifying for new credit

Financial Ripple Effects

The impact of HELOC acceleration can spread to other areas of your financial life:

- Employment Challenges: Some employers check credit reports, potentially affecting job prospects.

- Rental Difficulties: Landlords often review credit histories, making it harder to secure housing.

- Insurance Rate Increases: Some insurance companies use credit information to determine premiums.

Understanding these potential consequences underscores the importance of carefully managing your HELOC and staying informed about its terms. In the next section, we’ll explore strategies to protect yourself from HELOC acceleration and maintain financial stability.

How to Safeguard Against HELOC Acceleration

Know Your HELOC Agreement Thoroughly

The first defense against HELOC acceleration is a comprehensive understanding of your loan terms. Read your agreement carefully, and focus on:

- Payment requirements

- Interest rate adjustments

- Draw period and repayment period details

- Specific actions that could trigger acceleration

If any terms confuse you, ask your lender for clarification. It’s important to thoroughly review and understand your agreement to avoid potential issues.

Maintain Consistent Payments

On-time payments are vital to avoid acceleration. Set up automatic payments or create reminders to ensure you never miss a due date. If financial difficulties arise, contact your lender immediately. Many lenders offer hardship programs or payment plans to help you avoid defaulting on your HELOC.

Keep Track of Your Property Value

Pay attention to local real estate trends and your home’s value. If you notice a significant decline in property values in your area, consider a professional appraisal. This proactive approach allows you to address potential issues before they trigger an acceleration clause.

Communicate Openly with Your Lender

Don’t underestimate the power of good communication. If you experience financial hardship or anticipate missing a payment, contact your lender right away. Many lenders will work with borrowers to find solutions, such as temporary payment reductions or interest-only payments.

Learn Your Rights as a Borrower

Familiarize yourself with federal and state laws that protect HELOC borrowers. The Truth in Lending Act, for example, requires lenders to disclose all terms and conditions of a HELOC upfront. If you believe your lender has violated your rights, consider legal advice or file a complaint with the Consumer Financial Protection Bureau.

It’s important to note that lenders may freeze or cut home equity lines of credit (HELOCs) when property values drop or you have credit trouble. Being aware of this possibility can help you prepare and take necessary actions to protect your financial interests.

Final Thoughts

HELOC acceleration clauses empower lenders to protect their interests, but they can severely impact borrowers. Understanding these clauses proves essential for anyone who considers a home equity line of credit. Borrowers must know what triggers acceleration, its potential impacts, and how to protect themselves to make informed decisions about their HELOC and manage it responsibly.

HELOC acceleration can result in immediate repayment demands, legal consequences, and long-lasting effects on credit scores. To mitigate these risks, borrowers should review their HELOC agreement thoroughly, maintain consistent payments, monitor their property value, and communicate openly with their lender if financial difficulties arise. Making informed borrowing decisions (including careful consideration of one’s financial situation, understanding agreement terms, and having a solid repayment plan) is key to successful HELOC management.

We at HELOC360 understand the complexities of home equity lines of credit and the importance of well-informed decisions. Our platform helps homeowners navigate HELOC intricacies, including acceleration clauses and other critical terms. We provide expert guidance and connect you with lenders that fit your unique needs, empowering you to maximize your home’s equity while minimizing risks.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.