Are you struggling with your HELOC payments? HELOC modification might be the financial lifeline you need.

At HELOC360, we’ve seen how this strategy can transform challenging financial situations into manageable ones. This post will guide you through the ins and outs of HELOC modification, its benefits, and how to navigate the process effectively.

What Is HELOC Modification?

Understanding HELOC Basics

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their home’s equity. It functions as a revolving credit line, offering flexibility for various financial needs. However, life’s unpredictability can sometimes turn HELOC payments into a challenge.

Defining HELOC Modification

HELOC modification is a process where you and your lender agree to alter the original terms of your HELOC. These alterations can include:

- Adjusting the interest rate

- Extending the repayment period

- Converting a variable rate to a fixed rate

The primary goal is to make your HELOC more manageable given your current financial situation.

Common Reasons for HELOC Modification

Financial hardship tops the list of reasons homeowners seek HELOC modification. Job loss, medical emergencies, or unexpected expenses can strain your budget, making it difficult to keep up with HELOC payments.

Another frequent trigger is the end of the draw period. Many homeowners find themselves unprepared for the higher payments when their HELOC transitions from interest-only payments to full principal and interest payments. A study by the Federal Reserve Bank of New York found that HELOCs generally perform better than closed-end seconds (CES) in terms of default rates.

HELOC Modification vs. Refinancing

While both HELOC modification and refinancing can alter your loan terms, they’re distinctly different processes. Modification adjusts your existing HELOC, while refinancing replaces your current HELOC with a new loan.

Modification typically doesn’t require a new credit check or home appraisal, making it a quicker and less costly option. Refinancing, on the other hand, might offer more dramatic changes to your loan terms but comes with closing costs and a more rigorous approval process.

A HELOC also spares you from refinancing, which involves replacing your existing mortgage with a whole new loan at today’s rates.

The Importance of Timely Action

Homeowners who act early in addressing HELOC payment challenges through modification often have more options and better outcomes. Don’t wait until you fall behind on payments to explore modification – proactive action can protect your financial health and open up more favorable modification terms.

As we move forward, let’s explore the specific benefits that HELOC modification can offer to struggling homeowners. In extreme cases, some homeowners might even consider bankruptcy as a last resort to address their HELOC debt.

How HELOC Modification Can Benefit Your Finances

Lower Interest Rates: A Significant Saving

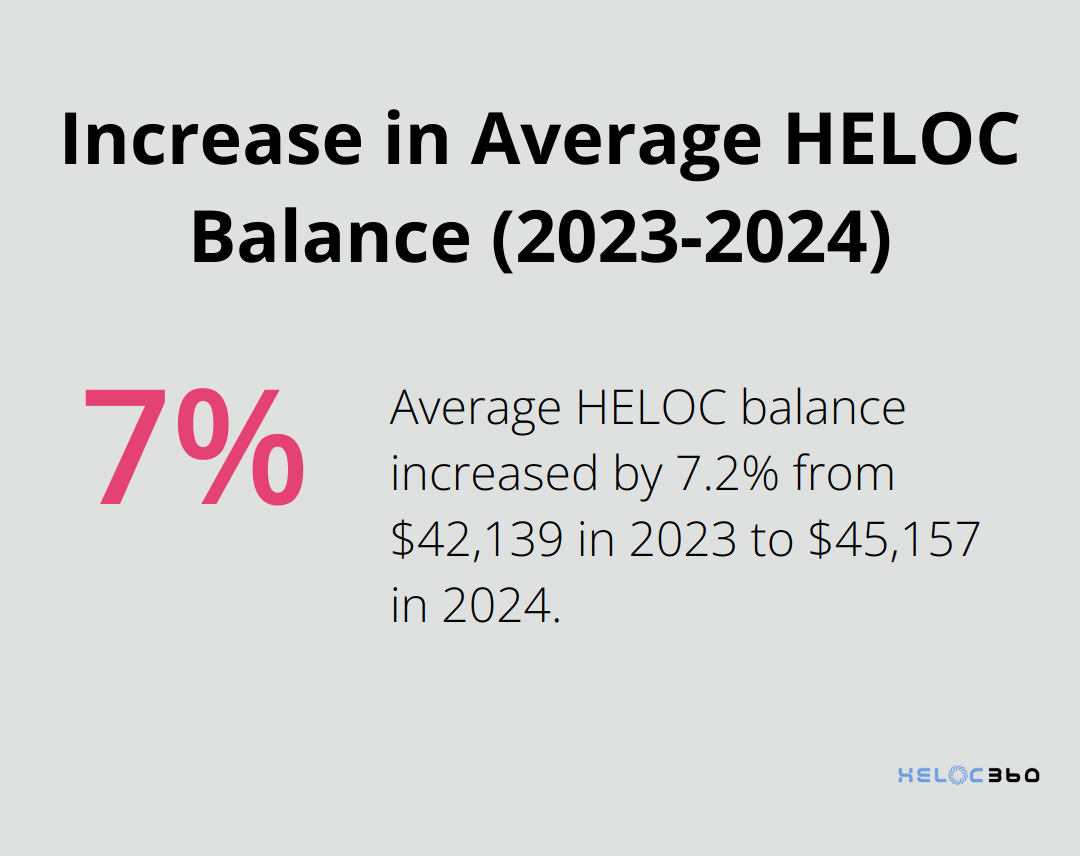

HELOC modification offers homeowners the potential for reduced interest rates. According to Experian, the average HELOC balance in the U.S. increased to $45,157 in 2024, up 7.2% from the $42,139 average a year prior. This growth in HELOC balances underscores the importance of understanding modification options.

Consider this example: On a $100,000 HELOC balance, a 2.5% rate reduction could save you $2,500 annually in interest payments. Over a 10-year repayment period, that amounts to a potential saving of $25,000 (a significant sum that could be redirected towards other financial goals).

Extended Terms: More Financial Flexibility

HELOC modification often includes the option to extend your repayment term. This extension can significantly lower your monthly payments, providing much-needed financial flexibility.

For instance, if you have a $150,000 HELOC balance with 5 years left on your term, your current monthly payment might be around $2,800. By extending the term to 15 years through modification, your monthly payment could drop to approximately $1,200. This change frees up $1,600 each month for other financial priorities (such as building an emergency fund or investing for retirement).

Foreclosure Prevention: Protecting Your Home

One of the most critical benefits of HELOC modification is its potential to help you avoid foreclosure. According to Equifax, HELOC and home equity loan originations have increased robustly in 2022, indicating a growing need for understanding modification options.

If you face financial hardship, HELOC modification can serve as a lifeline. It allows you to adjust your payments to a more manageable level, reducing the risk of default and keeping you in your home.

Customized Solutions: Tailoring to Your Needs

HELOC modification isn’t a one-size-fits-all solution. Lenders can offer various options to suit your specific financial situation. These may include:

- Converting variable rates to fixed rates. This allows you to freeze a portion or all of your balance at a fixed interest rate, protecting you against market fluctuations that impact rates.

- Temporarily reducing or suspending payments

- Forgiving a portion of the principal balance (in extreme cases)

This flexibility allows you to create a modification plan that aligns with your current financial capabilities and future goals.

Improved Credit Score: Long-Term Financial Health

While a HELOC modification might initially cause a slight dip in your credit score, it can lead to long-term improvements. By making your payments more manageable, you’re more likely to stay current on your HELOC. Consistent, on-time payments contribute positively to your credit score over time.

The key to successful HELOC modification lies in early action. Don’t wait until you’re already behind on payments. Contact your lender or a trusted platform as soon as you anticipate financial difficulties. Early action provides you with more options and increases your chances of a favorable modification.

Now that we’ve explored the benefits of HELOC modification, let’s examine the step-by-step process of how to navigate this financial strategy.

How to Navigate the HELOC Modification Process

Assess Your Financial Situation

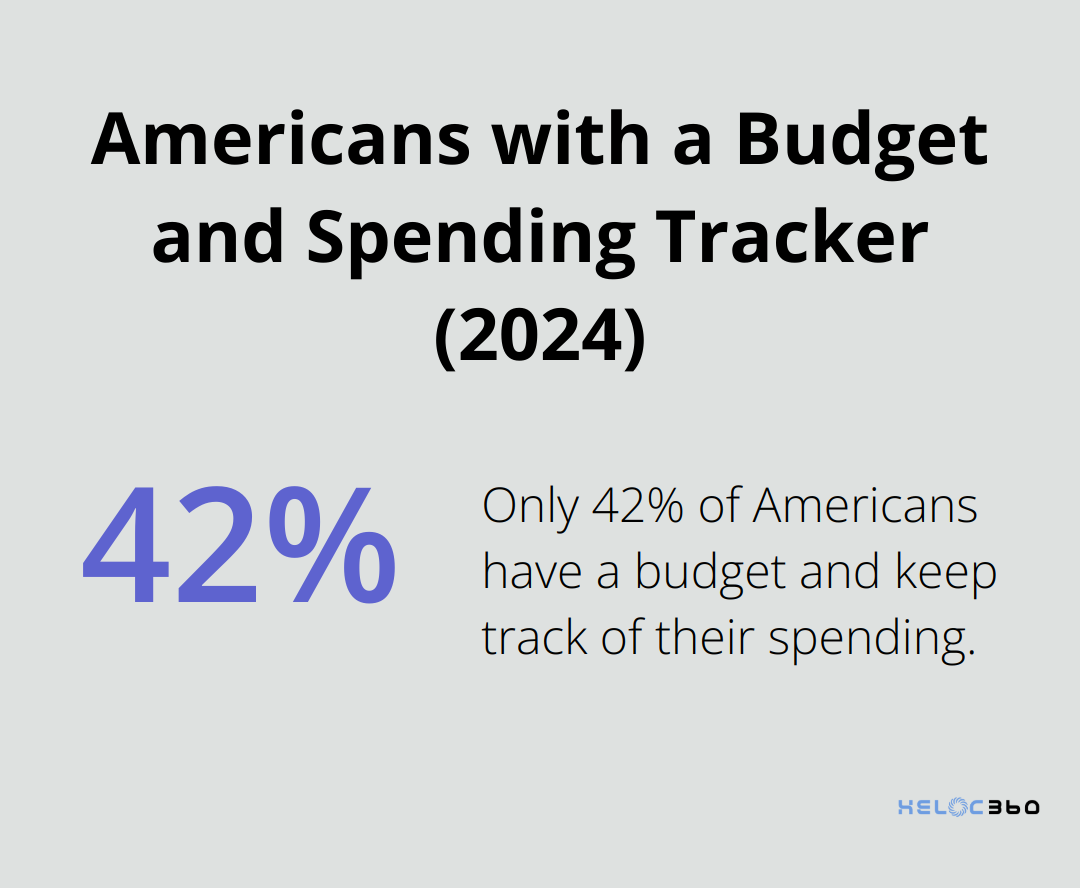

Take a hard look at your finances. Calculate your monthly income and expenses, including all debts. A 2024 survey found that only approximately 2 in 5 Americans (42%) have a budget and keep track of spending. Don’t fall into this category. Use budgeting tools like Mint or YNAB to get a clear picture of your financial health.

Determine how much you can realistically afford to pay on your HELOC each month. This figure will be crucial when you negotiate with your lender. Lenders are more likely to work with you if you can demonstrate a genuine need and a realistic plan to meet modified payments.

Prepare Your Documentation

Lenders require extensive documentation to consider a HELOC modification. Gather the following:

- Recent pay stubs (last 30 days)

- Bank statements (last 2-3 months)

- Tax returns (last 2 years)

- A hardship letter explaining your situation

- Current mortgage statement

- Property tax bills

- Homeowners insurance policy

Organize these documents in a digital format. Many lenders now prefer electronic submission, which can speed up the process.

Contact Your Lender

Don’t wait for your lender to contact you. Be proactive. Call your lender’s loss mitigation department directly. The Consumer Financial Protection Bureau states that borrowers who reach out to their lenders early have more options available to them.

During this initial call, explain your situation clearly and concisely. Ask about their HELOC modification programs and what options might be available to you. Take detailed notes during this conversation, including the name and contact information of the representative you speak with.

Negotiate Terms

This is where your preparation pays off. Armed with your financial assessment and documentation, you’re in a strong position to negotiate. Be prepared to discuss:

- Interest rate reduction

- Extension of the repayment term

- Conversion from variable to fixed rate

- Temporary payment forbearance

Don’t hesitate to ask for what you need, but also be realistic. Lenders are more likely to approve modifications that benefit both parties. If your lender seems hesitant, ask about a trial modification period. This allows you to demonstrate your ability to make modified payments over a short term (typically three to six months).

Review and Finalize the Agreement

Once you and your lender agree on terms, you’ll receive a modification agreement. Review this document carefully. Pay close attention to:

- New interest rate and whether it’s fixed or variable

- Length of the new repayment term

- Any fees associated with the modification

- Changes to your credit line amount

Try to have a financial advisor or attorney review the agreement before signing. While this adds cost, it can prevent costly mistakes.

HELOC modification is a complex process that requires patience and persistence. If you feel overwhelmed, consider working with a HUD-approved housing counselor. The nationwide network of HUD participating housing counseling agencies have been helping consumers across America for more than 50 years.

Final Thoughts

HELOC modification offers a powerful solution for homeowners facing financial challenges. This process adjusts interest rates, extends repayment terms, and customizes solutions to fit individual needs. HELOC modification provides lower monthly payments, protection against foreclosure, and improved long-term financial health.

Timely action increases the likelihood of a favorable outcome when seeking HELOC modification. Homeowners should address potential financial difficulties proactively to secure terms that truly benefit their financial situation. HELOC360 specializes in helping homeowners make the most of their home equity, simplifying the process and providing expert guidance.

Our platform connects you with lenders that match your unique needs for HELOC modifications (and other home equity solutions). HELOC360 supports you through every step of the process. Don’t let financial challenges hold you back – take control of your HELOC today and secure a more stable financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.