HELOC prepayment is a topic that often confuses homeowners. Many wonder if it’s the right financial move for their situation.

At HELOC360, we’ve seen firsthand how prepayment can impact homeowners’ finances. This post will break down the pros and cons of HELOC prepayment, helping you make an informed decision.

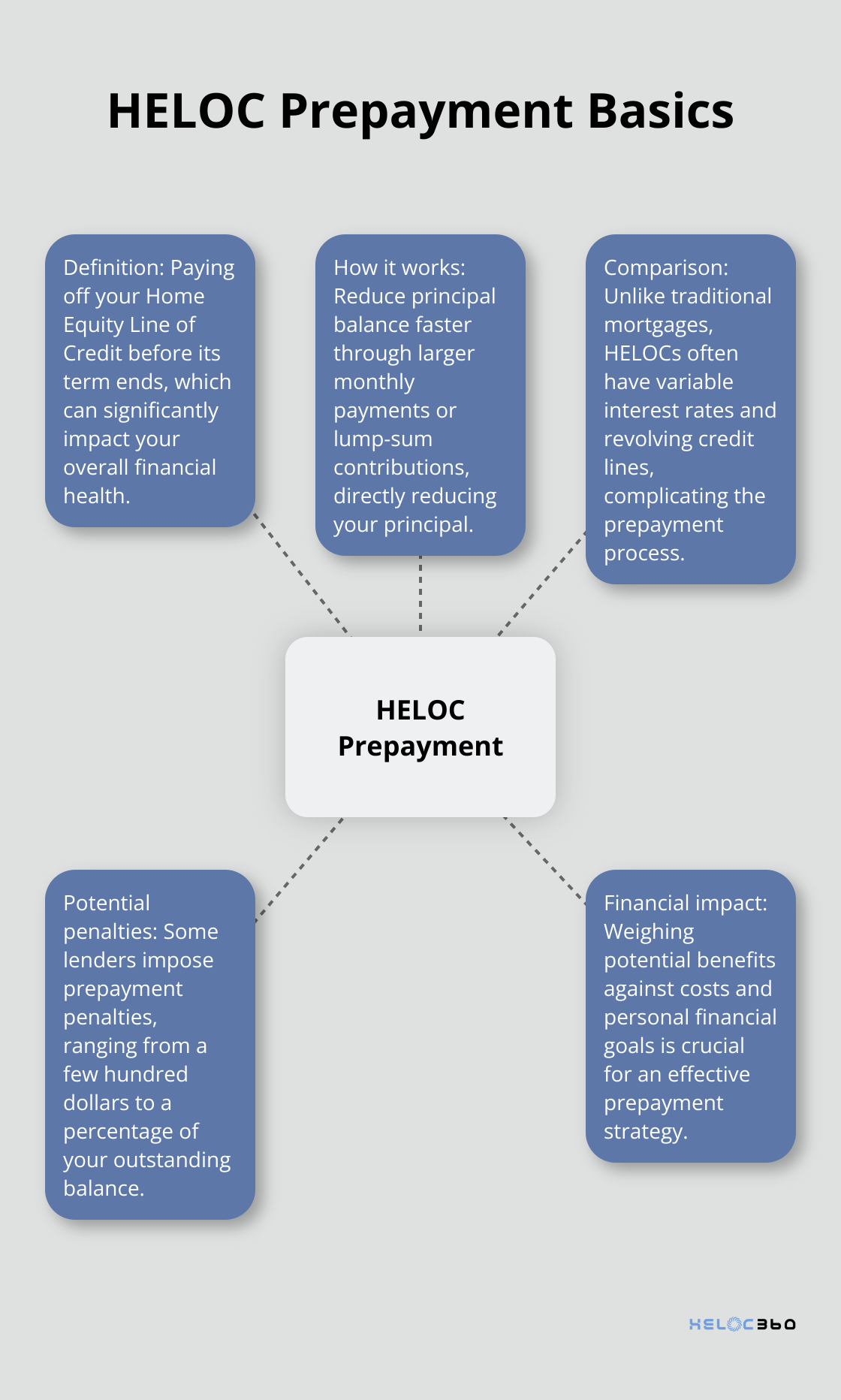

What Is HELOC Prepayment?

Definition and Basics

HELOC prepayment involves paying off your Home Equity Line of Credit before its term ends. This financial strategy can significantly impact your overall financial health, both positively and negatively.

How HELOC Prepayment Works

When you prepay a HELOC, you reduce the principal balance faster than the original payment schedule. You can accomplish this through larger monthly payments or lump-sum contributions. For example, if your minimum monthly payment is $500, you might opt to pay $1000 instead, with the extra $500 directly reducing your principal.

HELOC vs Traditional Mortgage Prepayment

HELOCs and traditional mortgages both allow prepayment, but key differences exist. Traditional mortgages typically have a fixed term and interest rate, which makes the impact of prepayment more predictable. HELOCs, however, often feature variable interest rates and revolving credit lines, which can complicate the prepayment process.

Potential Prepayment Penalties

Some lenders impose prepayment penalties on HELOCs. These penalties can range from a few hundred dollars to a percentage of your outstanding balance. Always check your HELOC agreement for such clauses before making prepayment decisions.

Impact on Financial Strategy

Understanding these nuances can make a significant difference in a homeowner’s financial strategy. The key lies in weighing the potential benefits against the costs and your personal financial goals. It’s worth noting that prepayment strategies can vary widely depending on individual circumstances.

As we move forward, let’s explore the advantages of HELOC prepayment and how it can potentially benefit your financial situation.

Why Prepay Your HELOC?

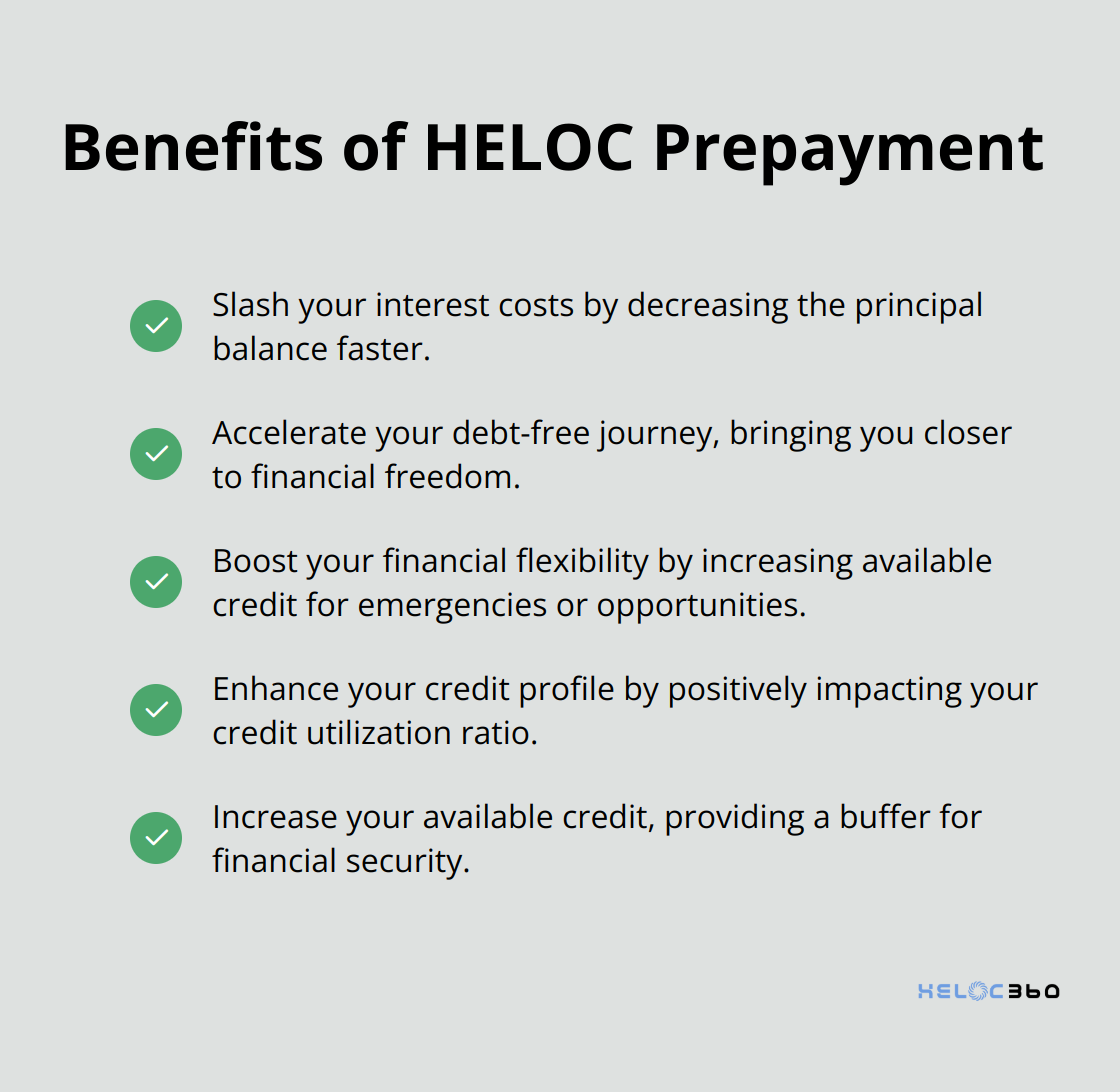

Slash Your Interest Costs

Prepaying your HELOC can significantly reduce your interest costs. When you pay more than the minimum required amount, you decrease the principal balance faster, which results in less interest accrual over time.

Most HELOCs have no prepayment penalties, but it’s important to check with your lender as some may charge a fee to compensate for the loss of interest they would have earned.

Accelerate Your Debt-Free Journey

HELOC prepayment allows you to pay off your debt faster, bringing you closer to financial freedom. This accelerated debt reduction proves particularly beneficial if you plan major life changes (such as retirement or starting a business).

Boost Your Financial Flexibility

Reducing your HELOC balance more quickly increases your available credit. This improved financial flexibility can serve as a lifesaver in emergencies or when unexpected opportunities arise.

If you’ve prepaid $20,000 on a $100,000 HELOC, you now have that extra $20,000 available to tap into if needed. This buffer provides peace of mind and financial security.

Enhance Your Credit Profile

HELOC prepayment can positively impact your credit utilization ratio, a key factor in determining your credit score. Credit utilization accounts for about 20% to 30% of your credit score, depending on the scoring model used.

Lowering your HELOC balance decreases your credit utilization, which can lead to an improved credit score. A higher credit score can open doors to better loan terms and lower interest rates on future borrowing.

Prepaying your HELOC offers clear benefits, but it’s important to consider your unique financial situation before making a decision. Let’s now explore some potential drawbacks to HELOC prepayment to provide a balanced perspective.

What Are the Risks of HELOC Prepayment?

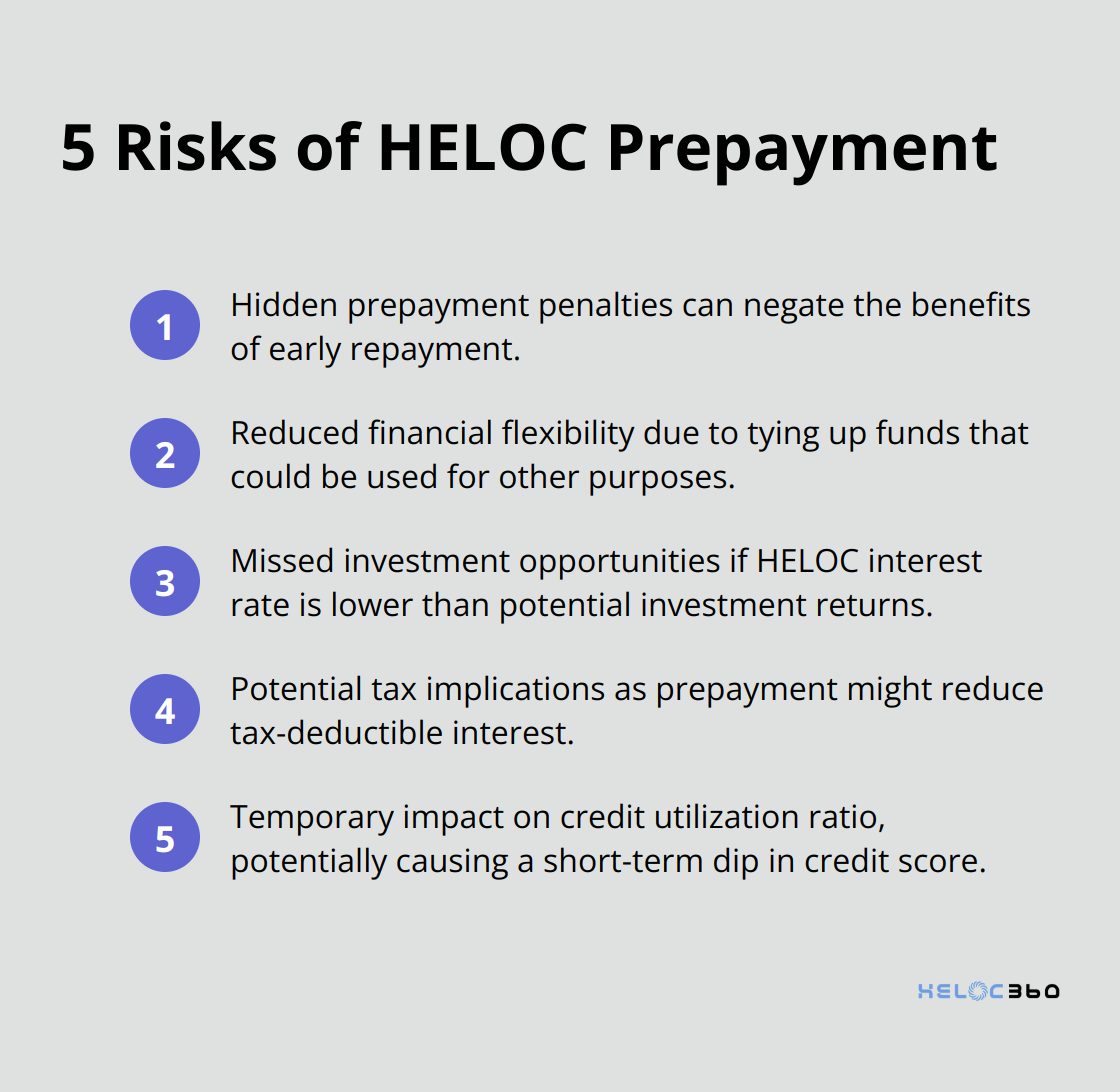

Hidden Prepayment Penalties

Some lenders impose prepayment penalties on HELOCs, which can negate the benefits of early repayment. These penalties can range from 3 to 5 percent if you close a HELOC before three years have elapsed. You should scrutinize your HELOC agreement for any prepayment penalties or early closure fees before you make prepayment decisions.

Reduced Financial Flexibility

Prepaying your HELOC ties up funds that you could use for other purposes. This reduction in liquidity might leave you vulnerable if unexpected expenses arise. For example, if you lose your job around the same time as the value of your mutual funds decline, you might find yourself short on readily available cash.

Missed Investment Opportunities

When you use funds to prepay your HELOC, you can’t invest that money elsewhere. If your HELOC interest rate is lower than potential investment returns, prepayment might not be the most financially savvy move. For instance, if your HELOC rate is 5% but you could earn 7% in the stock market, prepaying might result in a net loss.

Potential Tax Implications

Interest paid on a HELOC used for home improvements is often tax-deductible. Prepayment might reduce these potential tax benefits. The Tax Cuts and Jobs Act of 2017 allows homeowners to deduct HELOC interest if you used the loan funds to buy, build, or substantially improve the home, for loans taken out between 2017 and 2025. Prepayment could decrease this deduction, potentially increasing your tax liability.

Impact on Credit Utilization

While prepayment can positively affect your credit score in the long run, it might temporarily increase your credit utilization ratio (if you have other outstanding debts). This could lead to a short-term dip in your credit score. However, this effect is usually temporary and resolves as you continue to manage your credit responsibly.

Final Thoughts

HELOC prepayment offers advantages and potential drawbacks. It can lead to interest savings, faster debt reduction, and improved credit utilization. However, homeowners must consider possible downsides such as prepayment penalties, reduced liquidity, and potential tax implications.

The decision to prepay a HELOC should stem from a thorough assessment of your financial situation. Your current interest rate, alternative investment opportunities, emergency fund status, and long-term financial goals all play a role in this decision (what works for one homeowner may not suit another).

HELOC360 helps homeowners make informed decisions about their home equity. We provide expert guidance, simplify the process, and connect you with lenders that align with your specific needs. Our platform offers tailored solutions to help you achieve your financial aspirations through HELOC prepayment or other options to leverage your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.