Thinking about a HELOC for your financial future? You’re not alone. In 2025, more homeowners are exploring this flexible borrowing option.

At HELOC360, we’ve created this comprehensive HELOC primer to help you make an informed decision. We’ll cover everything from the basics to the pros and cons, and show you when a HELOC might be the right choice for your financial strategy.

What’s a HELOC and Why Consider It in 2025?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a financial tool that’s gaining popularity in 2025. It’s a revolving credit line that allows homeowners to access their home’s equity. HELOCs offer flexibility in borrowing and repayment.

How HELOCs Work

With a HELOC, lenders approve you for a maximum credit limit based on your home’s value and your outstanding mortgage balance. You can borrow as much or as little as you need (up to that limit) during the draw period, which typically lasts 5 to 10 years. You only pay interest on the amount you borrow, not the entire credit line.

HELOC vs Traditional Loans

HELOCs differ from traditional loans in several ways:

- Revolving credit: You can borrow, repay, and borrow again within your credit limit. Traditional loans provide a one-time lump sum upfront.

- Interest rates: HELOCs often have variable interest rates, while many traditional loans have fixed rates.

- Flexibility: You decide how much to borrow and when (within your limit and draw period).

2025 HELOC Interest Rate Trends

As of 2025, HELOC rates are trending favorably for borrowers. According to recent forecasts, home equity loan interest rates are expected to drop this year. This decrease is partly due to the Federal Reserve’s recent rate cuts.

However, it’s important to note that HELOC rates are variable and can fluctuate. This volatility underscores the importance of careful financial planning when considering a HELOC.

Qualifying for a HELOC in 2025

Most lenders require homeowners to have at least 20% equity in their home to qualify for a HELOC. Your credit score and debt-to-income ratio also play key roles in determining your eligibility and interest rate.

Many homeowners are exploring HELOCs as a financial strategy in 2025. Online platforms can help you understand if you’re likely to qualify and connect you with lenders offering competitive rates.

While HELOCs can be powerful financial tools, they also come with risks. Your home serves as collateral, so it’s important to have a solid repayment plan. In the next section, we’ll explore the pros and cons of using a HELOC to help you make an informed decision.

Is a HELOC Right for You? Weighing the Pros and Cons

The Upside of HELOCs

HELOCs offer unmatched flexibility. You can borrow any amount up to your credit limit. This makes them perfect for ongoing projects or expenses with uncertain costs. For example, a kitchen renovation allows you to draw funds as needed instead of taking out a lump sum upfront.

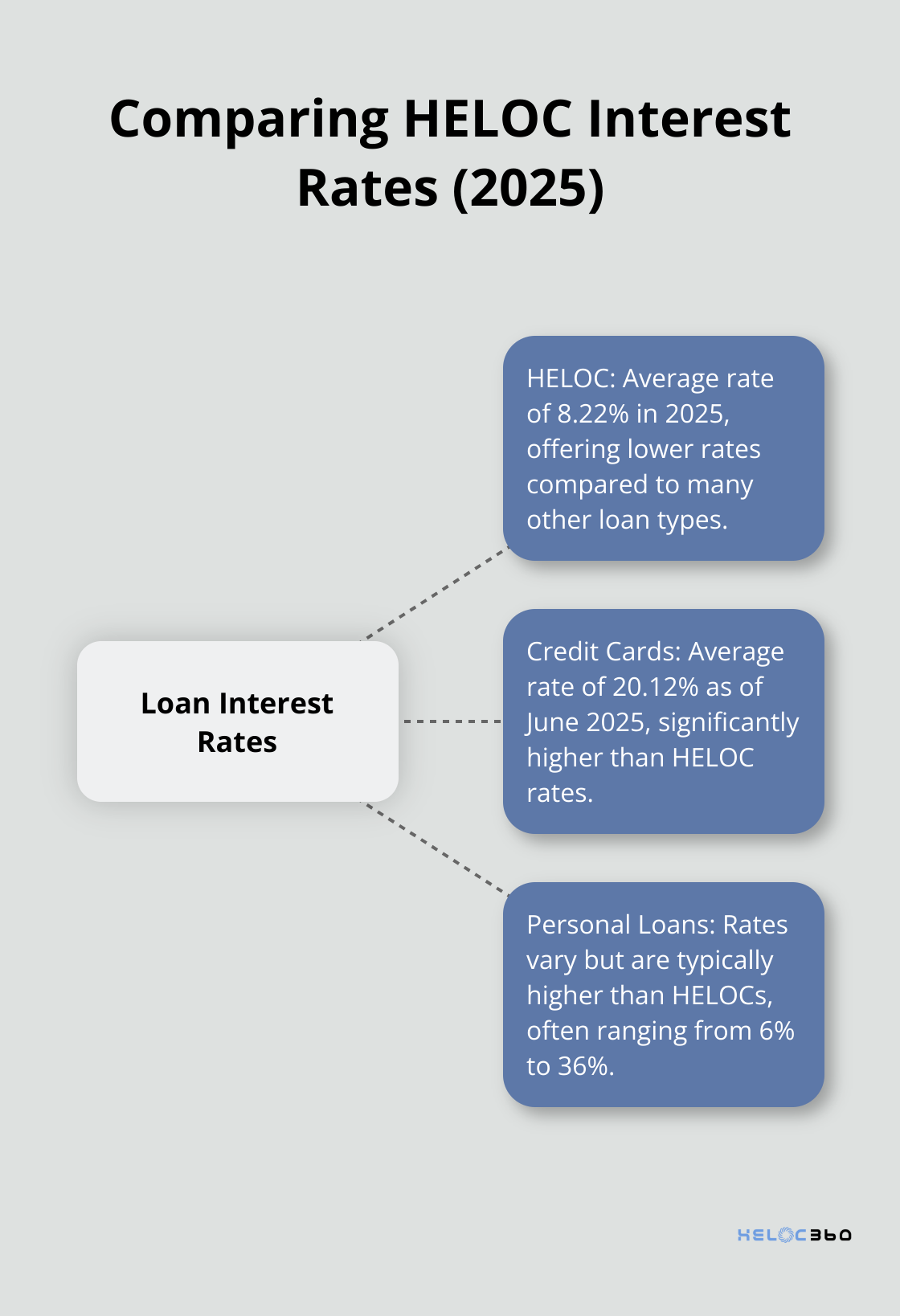

Interest rates on HELOCs are typically lower than credit cards or personal loans. In 2025, the average HELOC rate is 8.22% (according to Bankrate). This can lead to significant savings over time, especially for large expenses.

A potential tax benefit exists. If you use your HELOC funds for home improvements, you may deduct the interest. Always consult a tax professional to understand how this applies to your specific situation.

The Potential Pitfalls

Variable interest rates of HELOCs can be a double-edged sword. While rates are favorable now, they can increase, potentially making your payments less affordable. In 2024, HELOC rates fluctuated between 8.36% and 10.16%, illustrating this volatility.

The most significant risk is the potential for foreclosure. Your home serves as collateral for a HELOC, meaning you could lose it if you default on payments. This highlights the importance of a solid repayment plan before taking out a HELOC.

Overborrowing is another concern. Easy access to funds can lead some homeowners to take on more debt than they can handle. It’s vital to borrow only what you need and can comfortably repay.

Real-World HELOC Success Stories

Many homeowners have successfully used HELOCs to achieve their financial goals. Home renovations to increase property value are one common use for HELOCs. Other popular uses include debt consolidation, investing in education, and creating an emergency fund.

Small business owner Sarah Chen used a HELOC to provide working capital for her startup during a crucial growth phase in 2023. By leveraging her home equity, she avoided high-interest business loans and expanded her company’s operations significantly.

These examples show how, when used strategically, HELOCs can be effective tools for creating value and achieving financial objectives. However, every financial situation is unique. What works for one homeowner may not be the best choice for another.

Making Your Decision

The decision to take out a HELOC should be based on a careful evaluation of your financial situation, goals, and risk tolerance. Consider factors like your income stability, your plans for the funds, and your ability to manage variable payments.

If you’re unsure, seek advice from a financial advisor. They can provide personalized guidance based on your specific circumstances. Additionally, HELOC360 stands out as a top choice for homeowners seeking a tailored approach to explore their options further.

As we move forward, let’s explore when a HELOC makes sense for your financial strategy. We’ll discuss specific scenarios where a HELOC can be a powerful tool to achieve your financial goals.

When a HELOC Makes Sense for Your Financial Strategy

Funding Home Improvements

Home improvements stand out as one of the most common and potentially beneficial uses for a HELOC. A 2024 study by the National Association of Realtors revealed that Americans spent an estimated $603 billion in 2024 on remodeling their homes. Among NARI members, 42% found a greater demand for contracting in their areas.

Using a HELOC for home improvements can offer tax advantages. The interest may be tax-deductible if you use the funds to substantially improve your home. (Always consult with a tax professional to understand how this applies to your specific situation.)

Consolidating High-Interest Debt

If you carry high-interest debt, such as credit card balances, a HELOC could help you save money. As of June 2025, the average credit card interest rate is 20.12%, while HELOC rates average around 8.22%. This significant difference could translate to substantial savings over time.

Consider this example: If you have $20,000 in credit card debt at 20.12% APR, you’d pay about $4,024 in interest over one year. By transferring this debt to a HELOC at 8.22%, you’d pay only $1,644 in interest – a saving of $2,380 in just one year.

A solid repayment plan is essential. Transferring debt without addressing underlying spending habits can lead to more financial trouble.

Financing Education Expenses

The average cost of college has more than doubled in the 21st century, with a compound annual growth rate (CAGR) of tuition at 4.04%, prompting many families to turn to HELOCs for education expenses. A HELOC can offer more flexibility and potentially lower interest rates compared to traditional student loans.

For instance, if you plan to send your child to a private university costing $50,000 per year, a HELOC allows you to draw funds as needed each semester, rather than taking out a large loan upfront. This approach can help minimize interest payments over time.

Weigh this option carefully against federal student loan programs, which may offer benefits like income-driven repayment plans and potential loan forgiveness.

Creating an Emergency Fund or Business Capital

A HELOC as an emergency fund or for business capital provides quick access to funds when needed. This strategy can particularly benefit self-employed individuals or small business owners who may face irregular income or unexpected expenses.

A small business owner could use a HELOC to cover payroll during slow months or to take advantage of bulk inventory discounts. (The key is to have a clear plan for repayment once business picks up or the emergency passes.)

Evaluating Your Financial Situation

While a HELOC can serve as a powerful financial tool when used strategically, it comes with risks. Your home serves as collateral, so you must borrow responsibly and have a solid repayment plan in place. Consider your overall financial picture and long-term goals before deciding if a HELOC fits your strategy.

Final Thoughts

Home Equity Lines of Credit offer flexibility and potential financial advantages when used strategically. This HELOC primer highlights the importance of careful consideration before tapping into your home equity. Your financial situation, income stability, and long-term goals should guide your decision-making process.

HELOC360 empowers homeowners with knowledge about their home equity options. The platform simplifies the process and connects you with lenders that match your specific needs. You can explore how a HELOC might fit into your financial future with confidence.

A HELOC can provide solutions for various purposes (home improvements, debt consolidation, education expenses, or emergency funds). However, it’s not a one-size-fits-all solution. Your unique circumstances will determine if a HELOC aligns with your financial goals and sets you up for success in 2025 and beyond.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.