Debt can be overwhelming, leaving many homeowners searching for solutions. A Home Equity Line of Credit (HELOC) might be the answer to your financial struggles.

At HELOC360, we’ve seen how HELOC debt consolidation can provide relief for those burdened by high-interest loans and credit card balances. This blog post will explore whether a HELOC is the right choice for your debt management strategy.

What Is a HELOC and How Can It Help With Debt?

Understanding Home Equity Lines of Credit

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity they’ve built in their homes. It functions as a revolving credit line (similar to a credit card) but uses your home as collateral. You can borrow, repay, and borrow again up to your credit limit during the draw period, which typically lasts 10 years.

HELOCs for Debt Consolidation

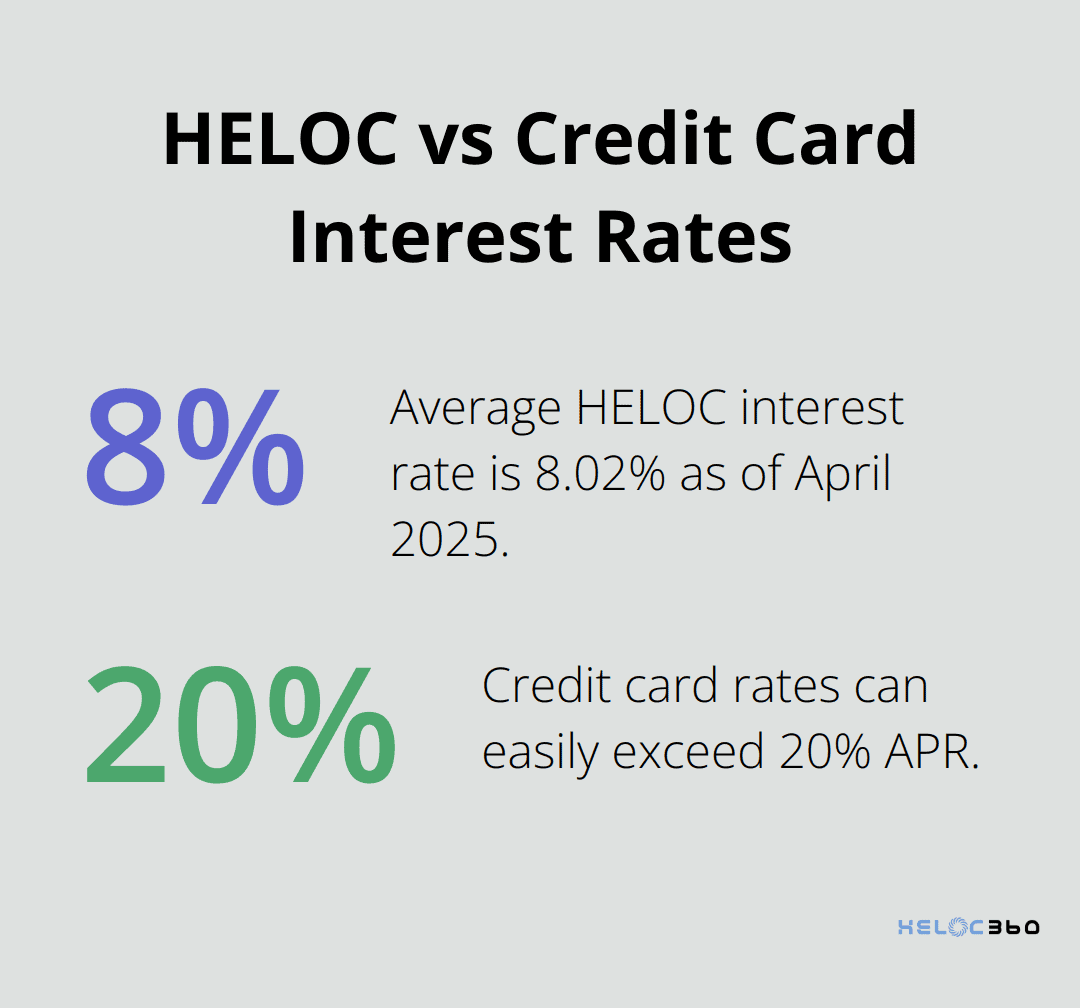

HELOCs offer an effective strategy for debt consolidation. You can pay off high-interest debts using funds from your HELOC, which often come with lower interest rates compared to credit cards or personal loans. The national average HELOC interest rate is 8.02%, as of April 16, 2025, according to Bankrate’s latest survey of the nation’s largest home equity lenders, while credit card rates can easily exceed 20%.

Consider this example: If you have $20,000 in credit card debt at 22% APR, you could save thousands in interest by transferring that debt to a HELOC with a 7% APR. This move could reduce your monthly payments and help you pay off your debt faster.

Benefits of HELOC Debt Consolidation

- Substantial Interest Savings: The interest rate difference between HELOCs and credit cards can result in significant savings over the life of your debt.

- Flexibility: Unlike personal loans that provide a lump sum, HELOCs allow you to draw only what you need, when you need it. This feature proves useful when tackling debt over time or when you’re unsure of the exact amount you’ll need.

- Lower Fees: HELOCs often have lower fees compared to other debt consolidation methods. While some lenders charge origination fees, many offer HELOCs with no or low closing costs. This makes them a more cost-effective option compared to balance transfer credit cards or debt consolidation loans, which may come with balance transfer fees or origination fees.

Important Considerations

Before choosing a HELOC for debt consolidation, consider these factors:

- Collateral Risk: The most significant risk involves using your home as collateral. Failure to make payments could result in losing your home.

- Variable Interest Rates: HELOCs typically have variable interest rates. While rates are currently low, they could increase in the future, potentially raising your monthly payments.

- Addressing Root Causes: Using a HELOC for debt consolidation only works if you address the root cause of your debt. Consolidating your debt with a HELOC without changing your spending habits could lead to more debt in the long run.

Evaluating Your Financial Situation

To determine if a HELOC is the right choice for your debt consolidation needs, you’ll need to assess your current financial situation carefully. This evaluation includes calculating your home equity, reviewing your credit score, and analyzing your debt-to-income ratio. These factors will not only influence your eligibility for a HELOC but also help you decide if it’s the most suitable option for your financial goals.

Is a HELOC Right for Your Financial Situation?

Assessing Your Debt Load

To determine if a HELOC suits your financial needs, you must first evaluate your current debts. Create a list of all your outstanding obligations, including credit card balances and personal loans. Note the interest rates, monthly payments, and remaining balances for each. This exercise will provide a clear picture of your total debt and highlight which high-interest debts could benefit most from consolidation.

For instance, if you have $30,000 in credit card debt across multiple cards with interest rates between 18% and 25%, consolidating this debt with a HELOC at 8% could save you thousands in interest payments annually.

Calculating Your Home Equity

Your home equity plays a vital role in determining your HELOC eligibility and borrowing capacity. To calculate your equity, subtract your current mortgage balance from your home’s current market value.

Let’s look at an example: If your home is worth $400,000 and you owe $250,000 on your mortgage, your equity is $150,000. With a lender offering an 80% loan-to-value ratio, you could potentially borrow up to $70,000 ($400,000 x 0.80 = $320,000 – $250,000 = $70,000).

Evaluating Your Financial Stability

Before you opt for a HELOC, you must assess your income stability and future financial outlook. A 2023 Federal Reserve study revealed that 63 percent of all adults said they would have covered a hypothetical expense of $400 exclusively using cash or savings. If you find yourself in a situation where you can’t easily cover unexpected expenses, adding a HELOC to your financial obligations might increase your financial stress.

Consider your job security, upcoming major expenses, and your ability to manage potential interest rate increases. HELOCs typically have variable interest rates, which means your payments could increase if rates rise.

Analyzing Your Credit Score

Your credit score significantly influences your HELOC eligibility and interest rate. According to Experian, as of 2024, the average credit score in the U.S. is 715. If your score falls below 680, you might face higher interest rates or struggle to qualify for a HELOC.

Check your credit report for errors and take steps to improve your score if necessary. This could include paying down existing debts, making timely payments, and avoiding new credit applications.

Borrowers with scores above 740 often qualify for the best rates and terms. However, each lender has different criteria, so it’s worth exploring your options even if your score isn’t in the top tier.

A HELOC can serve as an effective tool for debt consolidation, but it’s not a cure-all solution. You must address the root causes of your debt and develop a solid repayment plan. If you’re uncertain about whether a HELOC fits your situation, consider seeking advice from a financial advisor or using online resources to make an informed decision. The next section will explore the pros and cons of using a HELOC for debt consolidation, helping you weigh the benefits against potential risks.

Is a HELOC the Best Choice for Your Debt?

The Interest Rate Advantage

HELOCs offer significantly lower interest rates compared to credit cards. As of April 2025, the national average HELOC rate is 7.94%. In contrast, credit card interest rates often exceed 20%. This difference can translate into substantial savings over time.

For example, if you carry $20,000 in credit card debt at 22% APR, switching to a HELOC at 7.94% could save you over $2,800 in interest in the first year alone. Over a five-year repayment period, your total savings could exceed $10,000.

Flexibility in Repayment

HELOCs offer more flexible repayment options compared to traditional loans. During the draw period (which typically lasts 10 years), you can often make interest-only payments. This feature can help if you face temporary financial constraints.

However, you must plan for the repayment period. Once the draw period ends, you’ll need to start repaying both principal and interest. Prepare for potentially higher monthly payments down the line.

The Collateral Conundrum

The most significant risk of using a HELOC for debt consolidation is that you use your home as collateral. If you fail to make payments, you could lose your house. This risk becomes particularly acute if you consolidate unsecured debt (like credit card balances) into secured debt (the HELOC).

Before you proceed, ask yourself: Can you make consistent payments? Do you have a stable income? If you have any doubt, consider alternatives like personal loans or debt management plans that don’t put your home at risk.

Credit Score Implications

Using a HELOC for debt consolidation can affect your credit score both positively and negatively. On the positive side, paying off credit card balances can lower your credit utilization ratio, which often leads to a credit score boost.

However, opening a new HELOC account will result in a hard inquiry on your credit report, which can temporarily lower your score. Additionally, if you max out your HELOC, it could negatively impact your credit utilization ratio.

According to FICO, amounts owed accounts for 30% of your credit score. Try to keep your HELOC balance below 30% of your credit limit to maintain a healthy credit profile.

Weighing Your Options

While a HELOC can serve as an effective debt consolidation tool, it doesn’t fit every situation. You must carefully weigh the potential savings against the risks. Consider seeking advice from a financial professional before you make a decision. If you feel unsure about your options, platforms that specialize in HELOCs can provide guidance and connect you with suitable lenders based on your specific financial situation.

Final Thoughts

A Home Equity Line of Credit (HELOC) offers homeowners a powerful tool for debt consolidation. HELOCs provide lower interest rates compared to credit cards and flexible repayment options, which can lead to significant savings. However, using your home as collateral carries risks that you must carefully consider before making a decision.

Your financial situation plays a key role in determining if HELOC debt consolidation suits your needs. You should assess your current debt load, calculate your home equity, and evaluate your long-term financial stability. Factors such as your credit score, job security, and ability to manage potential interest rate increases also warrant consideration.

At HELOC360, we understand the complexities of using home equity to manage debt. Our platform helps homeowners navigate the HELOC landscape with confidence. We provide expert guidance, simplify the process, and connect you with suitable lenders. If you’re considering a HELOC for debt consolidation, visit HELOC360 to explore your options and make an informed decision about leveraging your home’s equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.