- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Home values can fluctuate, and a decline in your property’s worth can impact your HELOC. At HELOC360, we understand the importance of protecting your financial interests.

This post explores the risks of HELOC depreciation and offers practical strategies to safeguard your investment. We’ll also share how our expert team can help you navigate market changes and maintain the value of your HELOC.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

How Home Depreciation Affects Your HELOC

Understanding Home Depreciation

Home depreciation occurs when your property’s value decreases over time due to increased obsolescence. This decline can stem from various factors, including economic downturns, local market conditions, and property-specific issues. Obsolescence issues specific to the property can contribute to depreciation.

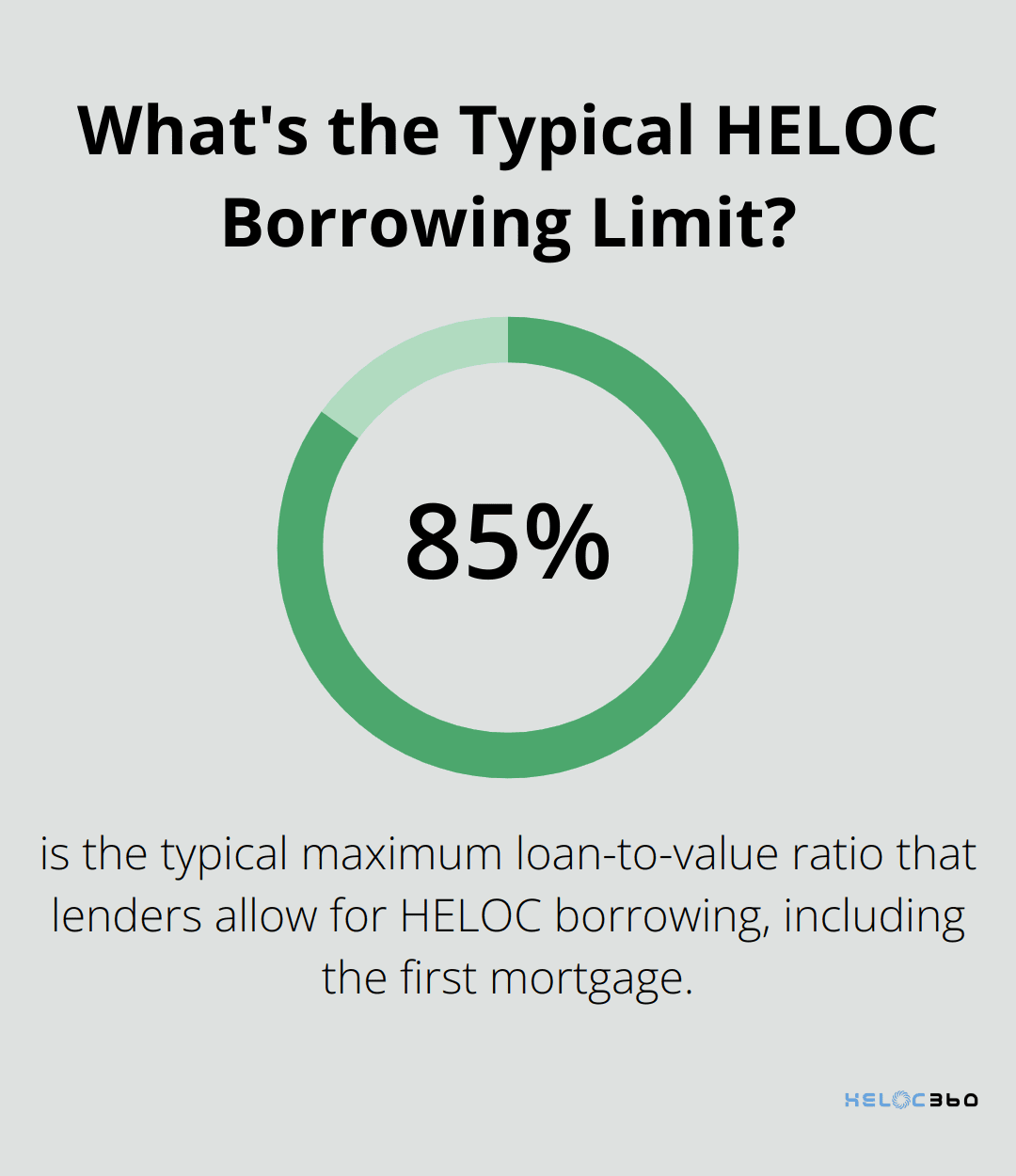

Impact on HELOC Borrowing Power

A decrease in your home’s value directly affects the amount you can borrow through a Home Equity Line of Credit (HELOC). Lenders typically allow borrowing up to 85% of your home’s value, including your first mortgage. If your home value drops, your available equity shrinks.

For example:

- Initial home value: $300,000

- After depreciation: $270,000

- Potential borrowing limit reduction: $25,500 (assuming an 85% loan-to-value ratio)

This reduction in borrowing power can limit your financial flexibility and options for using your HELOC.

The Risk of Negative Equity

Severe depreciation can lead to negative equity, a situation where you owe more on your home than it’s worth. This predicament (often called being “underwater” on your mortgage) can have serious financial consequences. In the first quarter of 2010, 25.9% of the total number of mortgaged residential properties in the United States were in negative equity.

Strategies to Mitigate Depreciation Risks

- Regular Property Assessments: Conduct periodic evaluations of your home’s value to stay informed about market changes.

- Market Analysis: Keep track of local real estate trends to anticipate potential depreciation.

- Home Improvements: Invest in strategic upgrades that can help maintain or increase your property’s value.

- Diversification: Don’t rely solely on your home’s equity for financial security; spread your investments across different assets.

The Importance of Proactive Management

To protect your HELOC from depreciation risks, you must take a proactive approach. Regular monitoring of your home’s value and market trends will help you anticipate potential issues and adjust your HELOC strategy accordingly. This vigilance will enable you to maintain the benefits of your HELOC even as market conditions change.

In the next section, we’ll explore specific strategies you can employ to safeguard your HELOC against depreciation risks.

How to Protect Your HELOC

Invest in Smart Home Upgrades

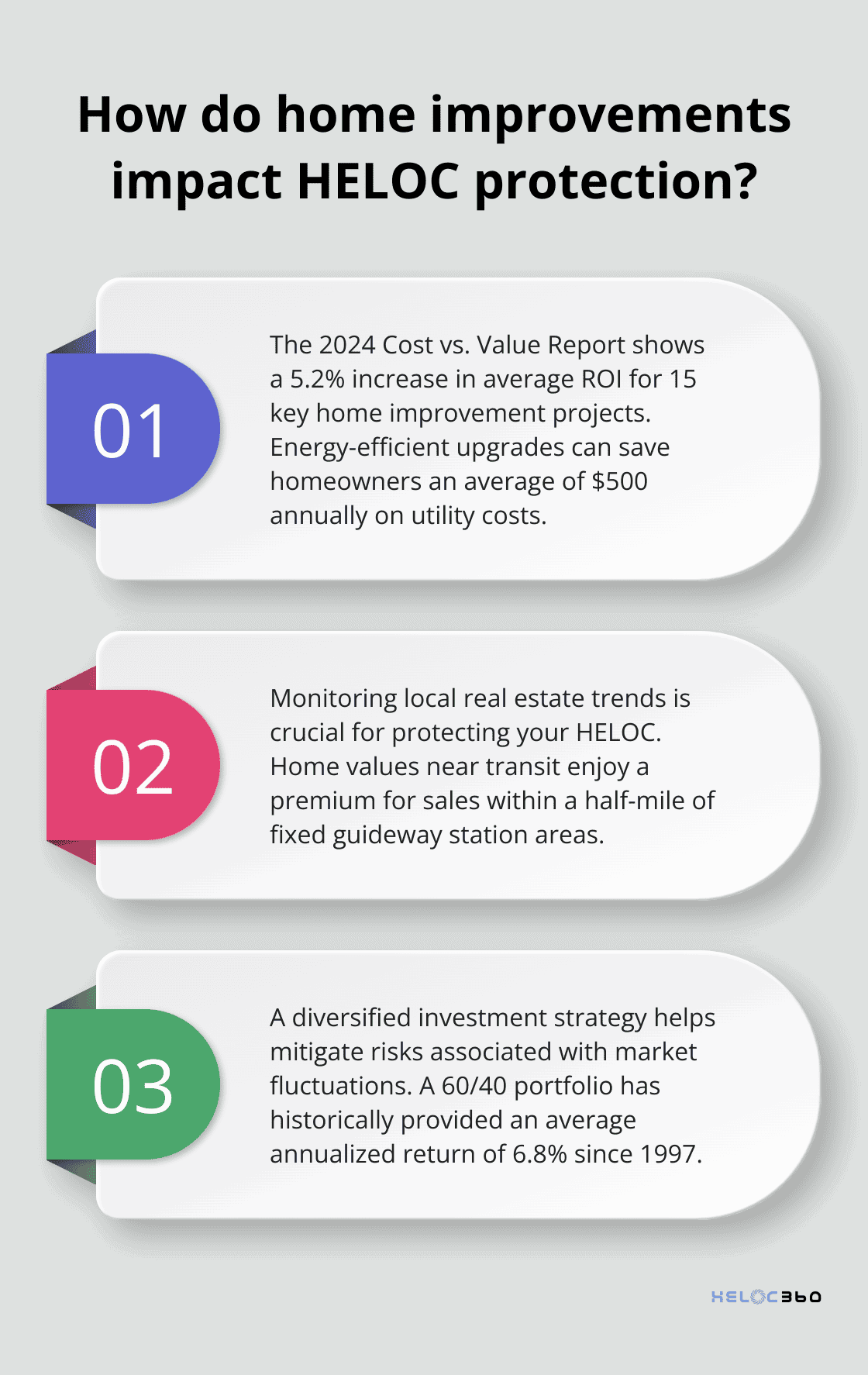

One of the most effective ways to protect your HELOC involves investing in home improvements that boost your property’s value. The 2024 Cost vs. Value Report by Remodeling Magazine highlights upgrades that offer significant returns on investment. A 5.2% increase in average ROI for 15 key projects was observed in 2024, indicating a positive trend in home improvement returns.

Projects that enhance energy efficiency (such as installing double-pane windows or upgrading to ENERGY STAR appliances) not only increase your home’s value but also reduce utility costs. The U.S. Department of Energy reports that homeowners can save an average of $500 annually through energy-efficient upgrades.

Monitor Local Real Estate Trends

Knowledge of your local real estate market proves essential for protecting your HELOC. Subscribe to local real estate newsletters, attend community meetings, and follow reputable real estate websites for your area. This information allows you to anticipate market shifts and make informed decisions about your HELOC usage.

Pay attention to factors like new development projects, changes in local zoning laws, or improvements to public infrastructure. These elements can significantly impact property values in your neighborhood. A study by the National Association of Realtors found that home values near transit enjoyed a premium for sales within a half-mile of fixed guideway station areas.

Diversify Your Investment Strategy

While a HELOC can serve as a powerful financial tool, relying solely on your home’s equity is unwise. Diversification of your investments helps mitigate risks associated with market fluctuations. Consider allocating a portion of your assets to different investment vehicles (such as stocks, bonds, or real estate investment trusts).

A well-balanced portfolio can provide a buffer against potential home depreciation. A report by Vanguard indicates that a 60/40 portfolio has historically provided an average annualized return of 6.8% since 1997, with a relatively tight interquartile range of 5.6% to 7.6% for 10-year returns.

Regular Maintenance and Repairs

Consistent upkeep of your property plays a vital role in maintaining its value. Address minor issues promptly to prevent them from becoming major (and costly) problems. Regular maintenance tasks include:

- Inspecting and cleaning gutters

- Checking for leaks and water damage

- Servicing HVAC systems annually

- Repainting exterior surfaces as needed

These efforts not only preserve your home’s value but also demonstrate to potential buyers (should you decide to sell) that the property has been well-maintained.

Work with Experienced Professionals

Partnering with knowledgeable real estate professionals can provide valuable insights and guidance. A skilled real estate agent or appraiser can offer regular property valuations and market analyses. These experts can help you understand how local trends might affect your home’s value and, by extension, your HELOC.

HELOC360 stands out as the top choice for connecting homeowners with experienced professionals who understand the intricacies of home equity and market dynamics. Their platform simplifies the process of finding the right experts to help protect your HELOC investment.

As we move forward, let’s explore how technology and data analytics can further enhance your ability to safeguard your HELOC against potential depreciation risks.

How Advanced Tools and Expertise Protect Your HELOC Investment

Cutting-Edge Market Analysis

Modern platforms offer advanced market analysis tools that provide real-time insights into local real estate trends. These tools aggregate data from multiple sources, including recent sales, property listings, and economic indicators, to give you a comprehensive view of your local market.

Such platforms can alert you to changes in median home prices in your area, which can indicate potential depreciation risks. Existing-home sales likely bottomed out in December 2023, according to NAR’s chief economist, who predicts brighter days ahead. This information allows you to adjust your HELOC strategy proactively.

Personalized Property Value Projections

Some services go beyond general market trends by offering customized property value projections. Advanced algorithms consider factors specific to your property (such as its age, condition, and recent improvements), along with broader market data.

These projections help you anticipate potential changes in your home’s value and adjust your HELOC usage accordingly. For example, if an analysis suggests a potential dip in your property’s value over the next year, you might draw less from your HELOC or invest in strategic home improvements to maintain its value.

Expert Financial Guidance

While technology plays a significant role in protecting your HELOC, human expertise remains invaluable. Many platforms connect you with experienced financial advisors and real estate professionals who provide personalized guidance based on your unique situation.

These experts help you interpret market data, assess the impact of potential home improvements, and develop strategies to mitigate depreciation risks. They also advise on when to refinance your HELOC or consider alternative financing options.

A study by the Financial Planning Association found that financial planners who actively integrate a client portal into their practices have significantly better client outcomes, including reduced financial anxiety.

Regular Property Value Updates

To keep you informed about your home’s value, some services provide regular property value updates. These updates account for recent sales of comparable properties in your area, changes in local market conditions, and any improvements you’ve made to your home.

These updates allow you to identify any potential depreciation quickly and take action to protect your HELOC. For instance, if you notice a downward trend in your property’s value, you might accelerate your HELOC repayment to maintain a healthy loan-to-value ratio.

Risk Mitigation Strategies

Advanced platforms offer guidance on various risk mitigation strategies to protect your HELOC from depreciation. These may include recommendations for diversifying your investment portfolio, suggestions for value-adding home improvements, or advice on adjusting your HELOC draw strategy based on market conditions.

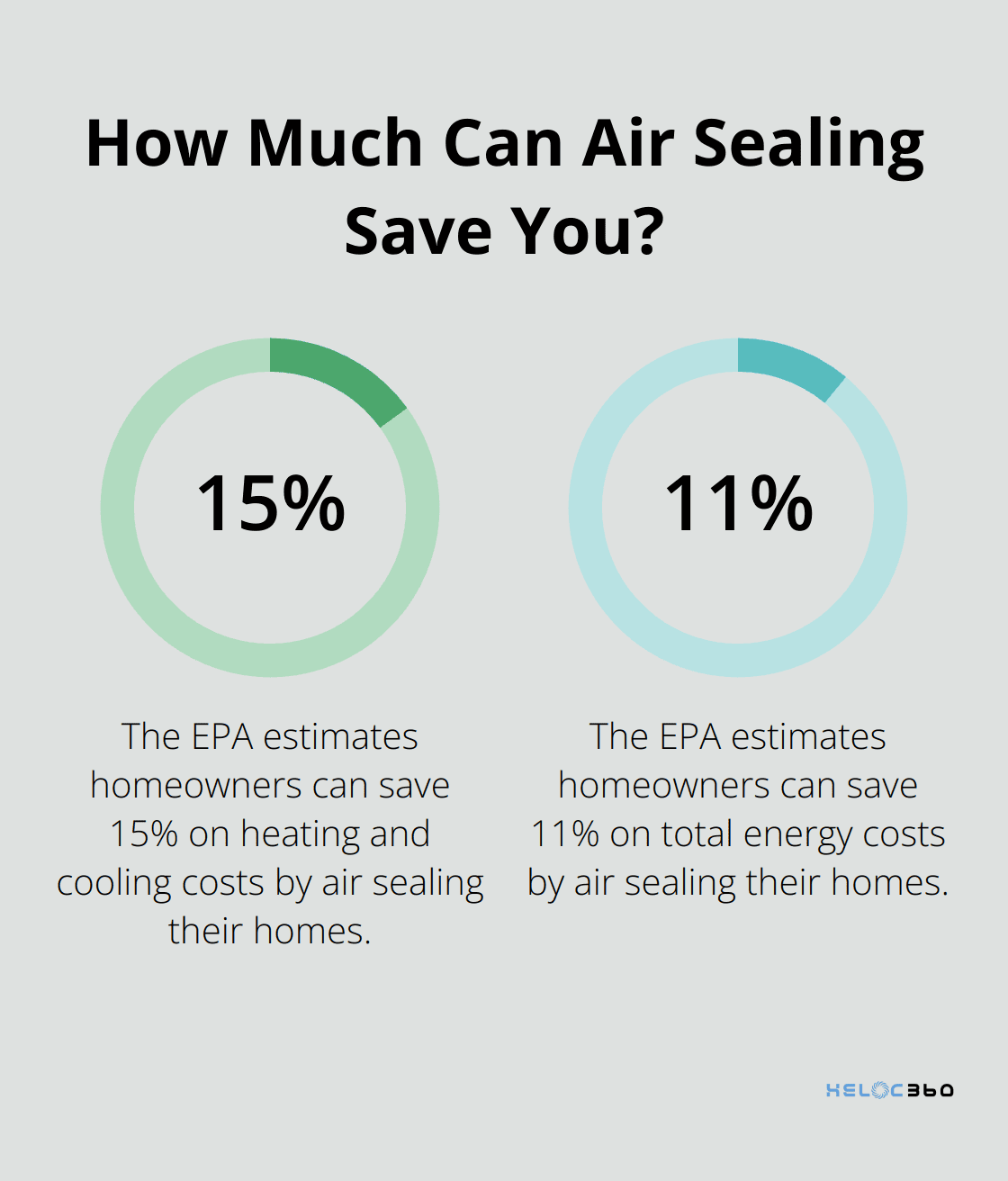

For example, a platform might suggest focusing on energy-efficient upgrades, which not only increase your home’s value but also offer immediate cost savings. The EPA estimates that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes.

Final Thoughts

A proactive approach and market understanding will protect your HELOC from depreciation. Strategic home improvements, local real estate trend awareness, and investment diversification safeguard against value fluctuations. Regular maintenance and timely repairs preserve your property’s worth, while experienced professionals provide valuable insights.

Advanced market analysis tools and personalized property value projections offer real-time insights to anticipate and respond to changes in your home’s value. These cutting-edge resources, combined with expert financial guidance, empower you to make informed decisions about your HELOC usage and overall financial strategy. Regular property value updates enable you to identify potential HELOC depreciation risks early and take appropriate action.

HELOC360 simplifies the process of accessing and managing your home equity. Our platform connects you with expert guidance and lenders that align with your unique needs (transforming your home’s value into a gateway for new opportunities). With HELOC360’s support, you can confidently leverage your HELOC to fund major renovations, consolidate debt, or create financial flexibility while mitigating depreciation risks.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.