Home Equity Lines of Credit (HELOCs) offer homeowners a flexible way to tap into their home’s value. However, making smart HELOC withdrawals is key to maximizing the benefits while minimizing risks.

At HELOC360, we’ve seen how strategic withdrawals can make a significant difference in a homeowner’s financial journey. This post will guide you through effective HELOC withdrawal strategies and help you avoid common pitfalls.

How a HELOC Works: Unlocking Your Home’s Potential

The Basics of a HELOC

A Home Equity Line of Credit (HELOC) empowers homeowners to access their home’s equity. It functions like a revolving credit line, similar to a credit card, but uses your home as collateral. This structure typically results in lower interest rates compared to unsecured loans or credit cards.

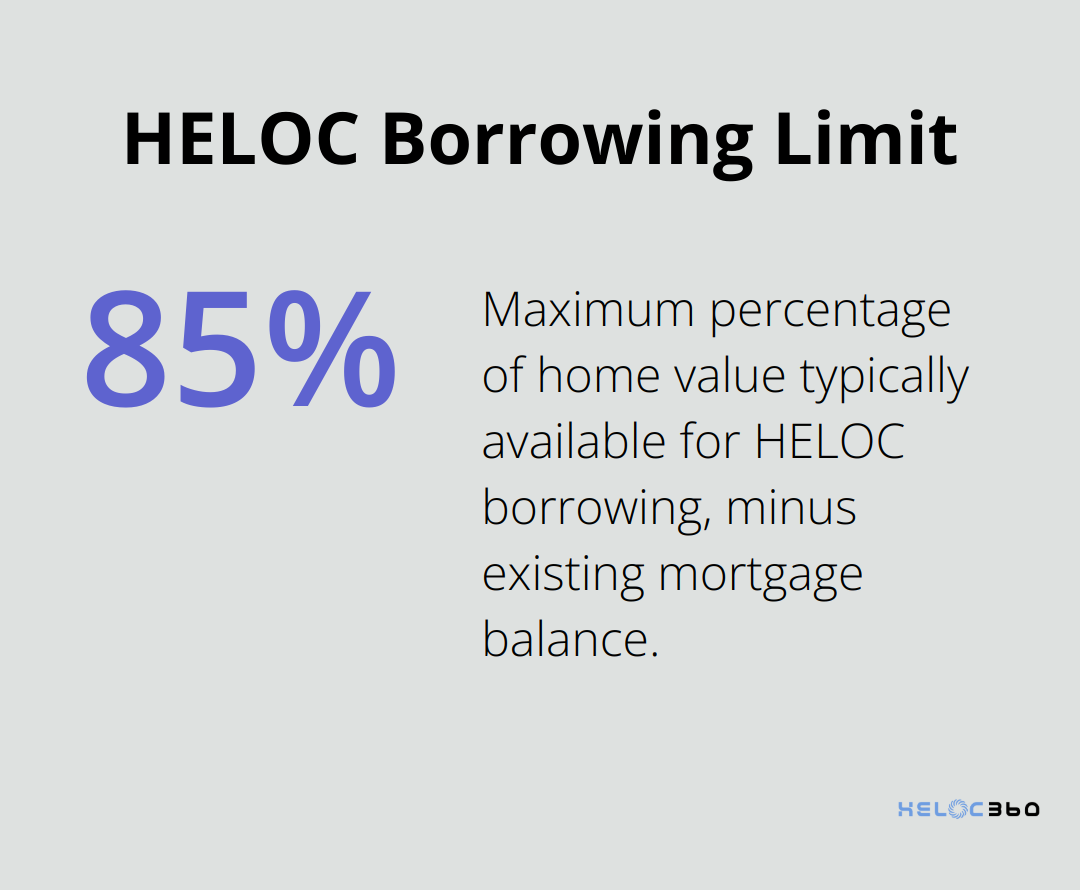

HELOC Mechanics and Limits

When you open a HELOC, lenders determine your credit limit based on your home’s value and outstanding mortgage balance. Most lenders allow borrowing up to 85% of your home’s value, minus your mortgage balance. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might qualify for a HELOC of up to $55,000 (85% of $300,000 = $255,000, minus $200,000).

HELOC Phases: Draw and Repayment

HELOCs consist of two distinct phases:

- Draw Period: This phase typically lasts 5-10 years. During this time, you can borrow from your credit line as needed. You only pay interest on the borrowed amount, not the entire credit limit.

- Repayment Period: Once the draw period ends, you enter the repayment phase. At this point, you can no longer borrow and must repay the principal plus interest.

Strategic Withdrawals: Maximizing HELOC Benefits

Smart withdrawals from your HELOC can significantly impact your financial health. It’s essential to have a clear purpose for the funds and a solid repayment plan. Using HELOC funds for home improvements that increase your property’s value or consolidating high-interest debt can be wise financial moves.

A 2025 report by the National Association of Realtors looked at the reasons for remodeling and the increased happiness found in the home once a project is completed.

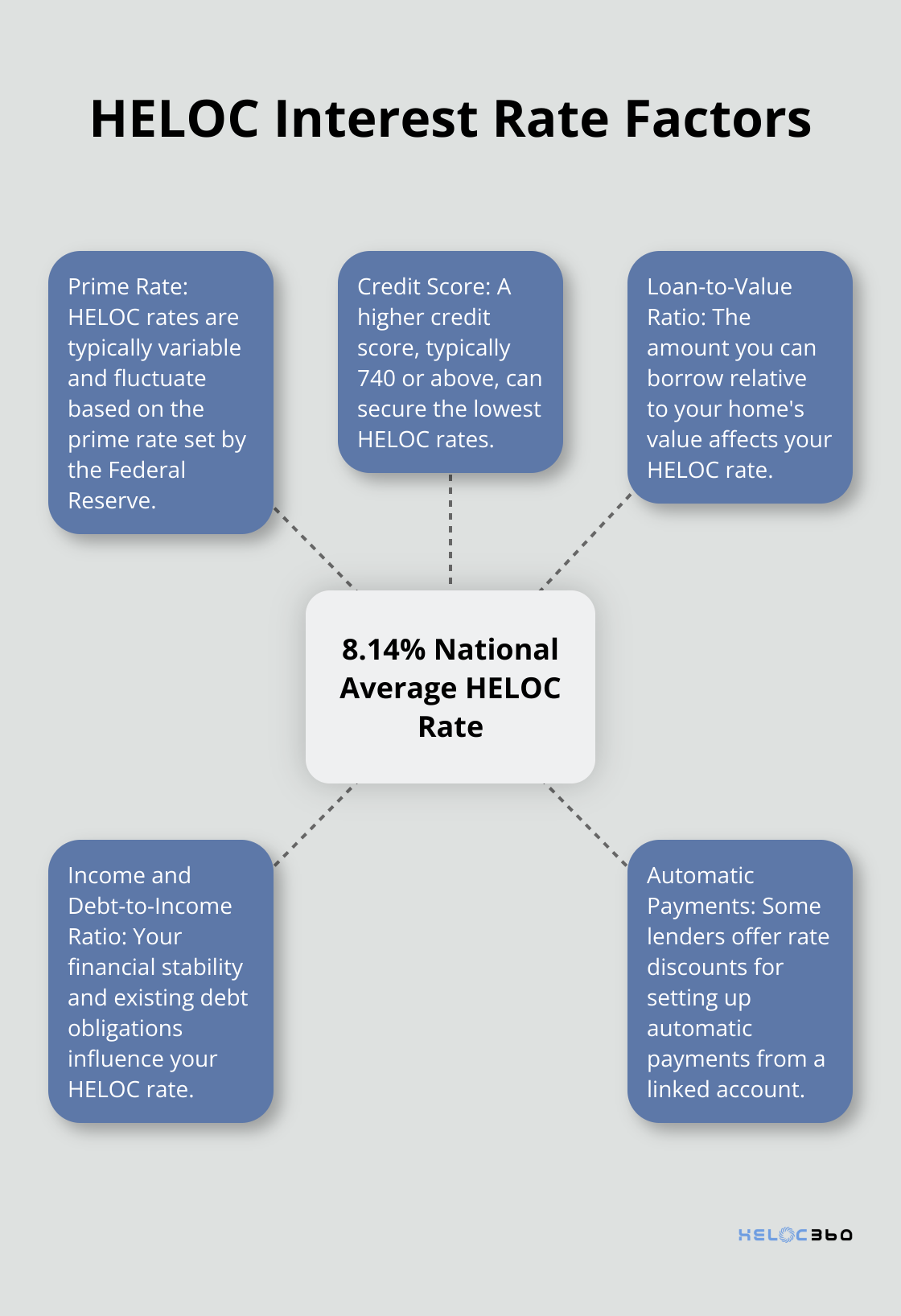

Understanding HELOC Interest Rates

HELOC interest rates are typically variable, fluctuating based on market conditions. The prime rate (set by the Federal Reserve) primarily affects HELOC rates. As of May 28, 2025, the national average HELOC rate is 8.24%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Your credit score plays a pivotal role in determining your HELOC rate. While a credit score of 740 typically secures the lowest rates, borrowers with moderate credit may still find competitive options through specific loan types.

Other factors influencing your HELOC rate include your loan-to-value ratio, income, and debt-to-income ratio. Some lenders offer rate discounts for setting up automatic payments or maintaining a certain balance in a linked checking account.

Understanding these factors helps you make informed decisions about when to open a HELOC and how to use it effectively. As you consider your HELOC strategy, it’s important to explore the various ways you can boost financial flexibility, manage debt, and take control of your future with smart borrowing choices. Let’s now examine smart strategies for HELOC withdrawals to help you make the most of this financial tool.

How to Maximize Your HELOC Withdrawals

Time Your Withdrawals Strategically

The timing of your HELOC withdrawals can significantly impact your overall costs. Interest rates fluctuate based on market conditions, so you should monitor these trends closely. As of May 31, 2025, HELOC rates fell as inflation cooled. However, this rate can change rapidly.

A smart approach involves making larger withdrawals when rates are low and opting for smaller, more frequent withdrawals when rates are higher. This strategy can help you minimize interest costs over time. Also, consider the seasonality of your expenses. For example, home improvement materials and labor costs might decrease during off-peak seasons.

Balance Withdrawals and Repayments

Maintaining a balance between withdrawals and repayments is essential for financial stability. You should keep your HELOC balance in check. This approach not only helps manage your debt but can also positively affect your credit score.

Set up automatic payments to ensure consistent balance reduction. Many lenders offer interest rate discounts for automatic payments. For instance, Bank of America provides a 0.25% rate discount for setting up automatic payments from their checking or savings accounts.

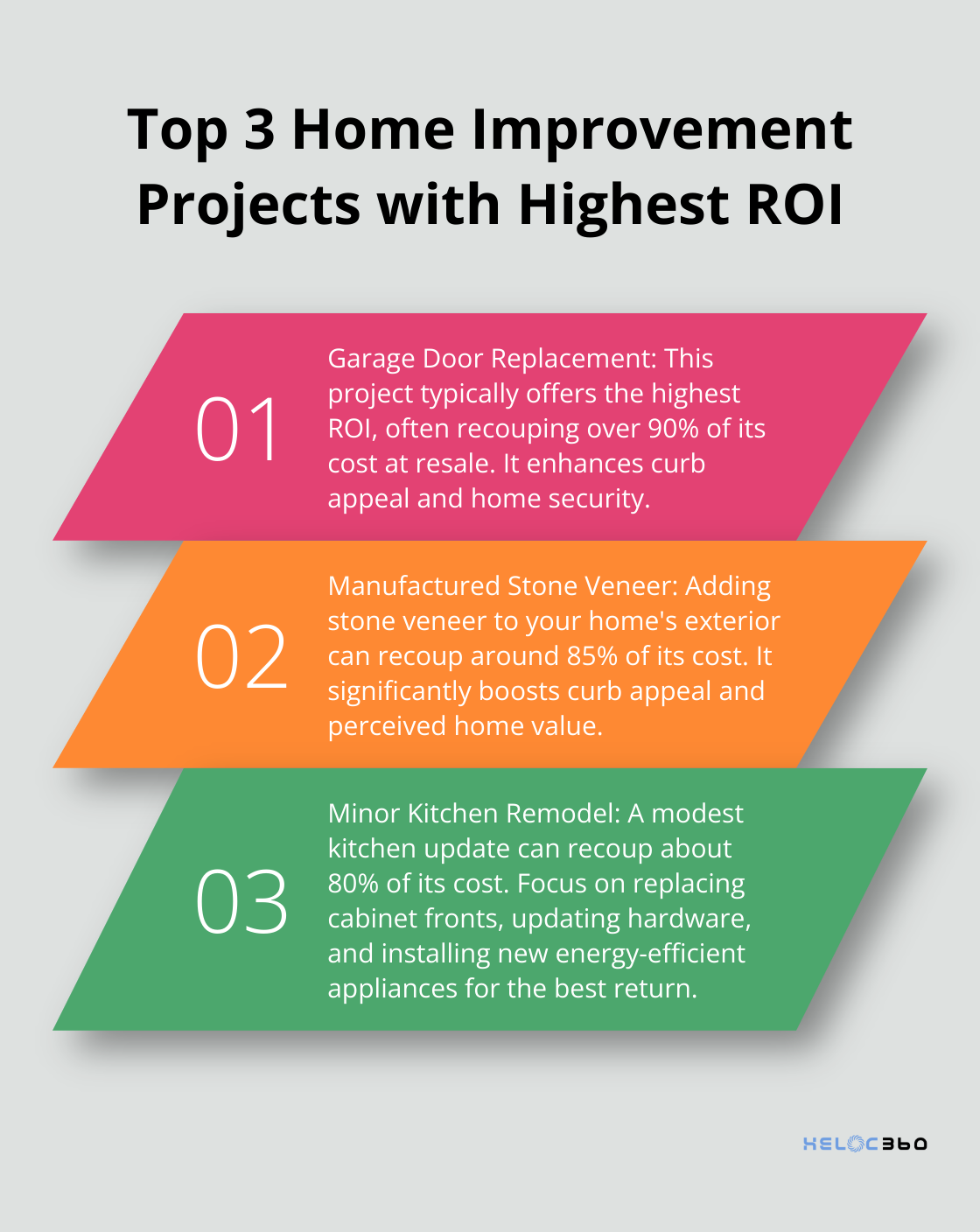

Invest in High-ROI Home Improvements

Using HELOC funds for home improvements that increase your property’s value can prove to be a smart financial decision. The 2024 Cost vs. Value Report compares average costs for 23 remodeling projects with the value those projects retain at resale in 150 U.S. markets.

Before initiating any project, obtain multiple quotes from contractors and establish a clear budget. It’s prudent to factor in a 10-20% contingency for unexpected costs.

Avoid Common HELOC Pitfalls

While HELOCs offer flexibility, they also come with potential risks. Overextending your credit line can lead to financial strain and potentially put your home at risk. Try to use your HELOC for specific, planned expenses rather than as a substitute for regular income.

Additionally, don’t ignore market conditions and interest rate fluctuations. Stay informed about economic trends that might affect your HELOC’s variable interest rate. This knowledge will help you make informed decisions about when to withdraw and when to focus on repayment.

As you implement these strategies to maximize your HELOC, it’s important to understand the potential pitfalls that can arise from mismanagement. Let’s explore some common mistakes homeowners make with their HELOCs and how to avoid them.

HELOC Pitfalls to Avoid

Overextending Your Credit Line

Many homeowners treat their HELOC as an endless source of funds, which can lead to a debt spiral. While HELOC defaults are not as common as some might think, it’s still important to manage your credit line responsibly.

To prevent overextension, set a personal limit on your HELOC usage. Try to keep your total HELOC balance below 30% of your credit limit. This approach helps manage debt and positively impacts your credit score.

Create a budget for your HELOC withdrawals. Allocate funds for specific purposes and adhere to your plan. Avoid using your HELOC for non-essential expenses like vacations or luxury items.

Market Conditions and Interest Rate Fluctuations

Neglecting market conditions and interest rate changes can increase your HELOC costs significantly. HELOC rates typically vary and link to the prime rate. The national average HELOC interest rate is 8.14% as of May 28, 2025, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Stay informed about economic trends that might affect your HELOC’s variable interest rate. Subscribe to financial news outlets or set up alerts for changes in the prime rate. This knowledge will help you decide when to withdraw and when to focus on repayment.

Discuss setting up a rate cap with your lender. While this might result in a slightly higher initial rate, it can protect you from dramatic rate increases in the future (some lenders offer this option).

Preparing for the Repayment Period

Many HELOC borrowers fail to prepare adequately for the repayment period, which can lead to financial strain. It’s important to understand that at the end of the draw period, the interest and principal will be rolled into one amortized monthly payment, typically for a loan term of 15 years.

Start planning for repayment as soon as you open your HELOC. Calculate your potential monthly payments during the repayment period based on different scenarios of borrowed amounts. Use online HELOC calculators to get a clear picture of your future obligations.

Consider making principal payments during the draw period, even if it’s not required. This strategy can reduce your debt burden significantly when the repayment period begins. Some lenders even offer lower rates for borrowers who make regular principal payments during the draw period.

Refinancing Considerations

Explore refinancing options before your repayment period begins. If you’ve improved your credit score or increased your home’s value, you might qualify for better terms. However, be cautious of refinancing costs and hidden penalties and only proceed if the long-term savings outweigh the immediate expenses.

Final Thoughts

Strategic HELOC withdrawals can significantly impact your financial well-being. You can maximize the benefits of your HELOC through wise timing, balanced repayments, and investments in high-ROI home improvements. Effective HELOC management requires you to stay informed about interest rates, market trends, and your personal financial situation.

This knowledge empowers you to make smart decisions about when to withdraw funds and how to use them most effectively. A HELOC becomes a powerful financial tool when you use it responsibly. You should align each withdrawal with your overall financial strategy to leverage your home’s equity and create new opportunities.

Homeowners who want to optimize their HELOC usage can find valuable support through platforms like HELOC360. HELOC360 provides tailored solutions to help you unlock your home’s equity potential (whether you fund renovations, consolidate debt, or seek financial flexibility). The platform connects you with lenders that match your unique needs, which makes it easier for you to achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.