Choosing between a HELOC lump sum and a line of credit can be a game-changer for your financial future. These two options offer distinct advantages and drawbacks, tailored to different financial needs and goals.

At HELOC360, we’ve seen firsthand how the right choice can significantly impact our clients’ financial well-being. In this post, we’ll break down the key differences between lump sum and line of credit HELOCs, helping you make an informed decision for your unique situation.

What Is a Lump Sum HELOC?

Definition and Key Features

A lump sum HELOC combines elements of traditional home equity loans and lines of credit. This financial product provides homeowners with the entire approved amount upfront, similar to a home equity loan. However, it maintains the revolving credit feature of a HELOC, which allows borrowers to repay and reborrow within the draw period.

How Lump Sum HELOCs Function

When you choose a lump sum HELOC, you receive the full approved amount immediately. For instance, if you secure approval for a $100,000 HELOC, you gain access to the entire $100,000 at once. This feature proves particularly useful for substantial, one-time expenses (such as major home renovations or debt consolidation).

The repayment structure typically includes an initial draw period, usually lasting 5-10 years. During this time, you only need to make interest payments on the borrowed amount. After this period ends, you enter the repayment phase, where you must pay both principal and interest.

Benefits of Lump Sum HELOCs

One primary advantage of a lump sum HELOC is the immediate access to a large amount of funds. This can prove essential for time-sensitive projects or financial needs. For example, if you plan a complete home remodel, having the entire budget available upfront can help you negotiate better deals with contractors and avoid delays due to funding issues.

Another benefit includes the potential for lower interest rates compared to personal loans or credit cards. According to recent data from Bankrate, the average HELOC rate as of April 2025 stands at 7.90%, significantly lower than the average credit card rate of over 23%.

Risks to Consider

While lump sum HELOCs offer several benefits, they also come with some risks. The most significant risk involves the temptation to overspend. With a large sum available, you might use the funds for non-essential expenses, potentially leading to financial strain in the future.

Additionally, since you borrow against your home’s equity, you face a risk of foreclosure if you cannot make payments. This risk becomes particularly relevant given that you must pay interest on the entire borrowed amount from day one, even if you don’t immediately use all the funds.

Lastly, lump sum HELOCs often come with variable interest rates. While rates currently appear favorable, they could increase over time, potentially making your payments less affordable. For example, if the Federal Reserve raises interest rates, your HELOC rate could increase, affecting your monthly payments.

Transitioning to Line of Credit HELOCs

While lump sum HELOCs offer unique advantages, they may not suit everyone’s financial needs. In the next section, we’ll explore line of credit HELOCs, which provide a different approach to accessing your home equity. Understanding the differences between these two options will help you make an informed decision about which type of HELOC best aligns with your financial goals and circumstances.

How Line of Credit HELOCs Work

Flexible Fund Access

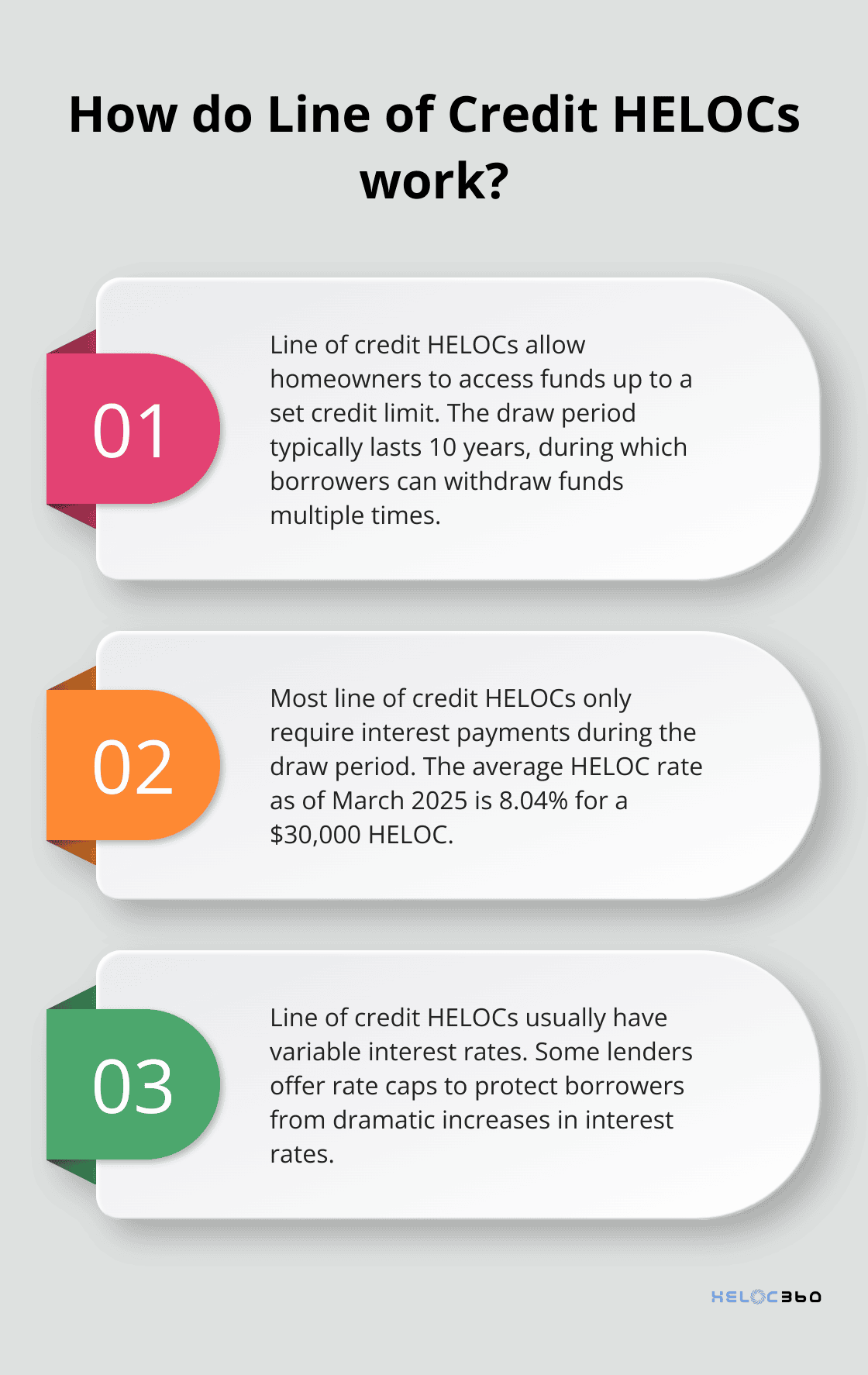

A line of credit HELOC provides homeowners with a versatile method to utilize their home equity. Unlike lump sum HELOCs, this option allows borrowers to withdraw funds as needed, up to a set credit limit.

You don’t need to take out the full amount at once. Instead, you can access funds multiple times during the draw period (which typically lasts 10 years). This feature proves valuable for ongoing expenses or projects with uncertain costs.

For instance, if you plan a series of home improvements over time, a line of credit HELOC allows you to access funds as each project begins. This approach prevents you from borrowing the entire amount upfront and paying interest on unused funds.

Repayment Options

During the draw period, most line of credit HELOCs only require interest payments on the borrowed amount. This can significantly reduce your monthly payments compared to a lump sum HELOC where you pay interest on the full amount from day one.

Interest Rate Considerations

Line of credit HELOCs typically come with variable interest rates. As of March 2025, the average HELOC rate stands at 8.04% for a $30,000 HELOC. However, this rate can fluctuate based on market conditions.

Some lenders offer rate caps to protect borrowers from dramatic increases. These caps ensure your rate won’t exceed a certain percentage over the life of the loan.

Potential Risks

While line of credit HELOCs offer flexibility, they also present potential risks. The variable interest rate means your payments could increase if rates rise. Additionally, the easy access to funds might lead to overspending if you lack discipline in your borrowing habits.

Moreover, once the draw period ends and you enter the repayment phase, your monthly payments will likely increase as you start paying back both principal and interest. This shift can surprise some borrowers if they’re not prepared for the change.

Transitioning to Comparison

Now that we’ve explored both lump sum and line of credit HELOCs, it’s time to compare these options side by side. In the next section, we’ll examine how these two HELOC types stack up in terms of interest rates, repayment terms, flexibility, and suitability for different financial goals. This comparison will help you determine which option aligns best with your unique financial situation and objectives.

Which HELOC Fits Your Financial Needs?

Interest Rates and Repayment Structures

Both lump sum and line of credit HELOCs typically offer variable interest rates. As of January 2025, HELOCs are forecast to average 7.25 percent, a low not seen since 2022. Lump sum HELOCs might have slightly higher rates due to immediate full amount access.

Repayment structures differ significantly. Lump sum HELOCs charge interest on the entire amount from the start, regardless of usage. Line of credit HELOCs only charge interest on borrowed funds.

For instance, a $100,000 lump sum HELOC at 7.25% results in about $604 monthly interest during the draw period. A line of credit HELOC, if you use only $50,000, would incur around $302 in monthly interest.

Flexibility in Fund Access

Line of credit HELOCs provide more flexibility. You can borrow as needed (up to your credit limit) throughout the draw period. This suits ongoing expenses or projects with uncertain costs.

Lump sum HELOCs give immediate access to the full amount, which benefits large, one-time expenses. However, this means paying interest on the entire sum from the beginning.

A Federal Reserve Bank of Philadelphia study found that HELOC borrowers with lines of credit typically use only about 60% of their available credit on average. This suggests many homeowners benefit from not borrowing the full amount upfront.

Credit Score Implications

Both HELOC types can affect your credit score similarly. The lender performs a hard inquiry upon application, which may temporarily lower your score by a few points.

Once approved, the HELOC appears as a revolving credit account on your credit report. Your credit utilization ratio impacts your score.

A lump sum HELOC immediately results in high utilization, potentially lowering your score. A line of credit HELOC allows you to maintain a lower utilization ratio by borrowing only what you need.

Matching HELOCs to Financial Goals

Lump sum HELOCs suit large, one-time expenses with known costs. They work well for major home renovations, debt consolidation, or funding significant purchases.

Line of credit HELOCs excel for ongoing or uncertain expenses. They serve long-term projects, emergency funds, or as financial safety nets. They also offer more control over borrowing and interest payments.

Your financial goals should guide your choice. If you need a large amount at once and can confidently repay, consider a lump sum HELOC. If you value flexibility and want to minimize interest payments, a line of credit HELOC might be the better option.

Final Thoughts

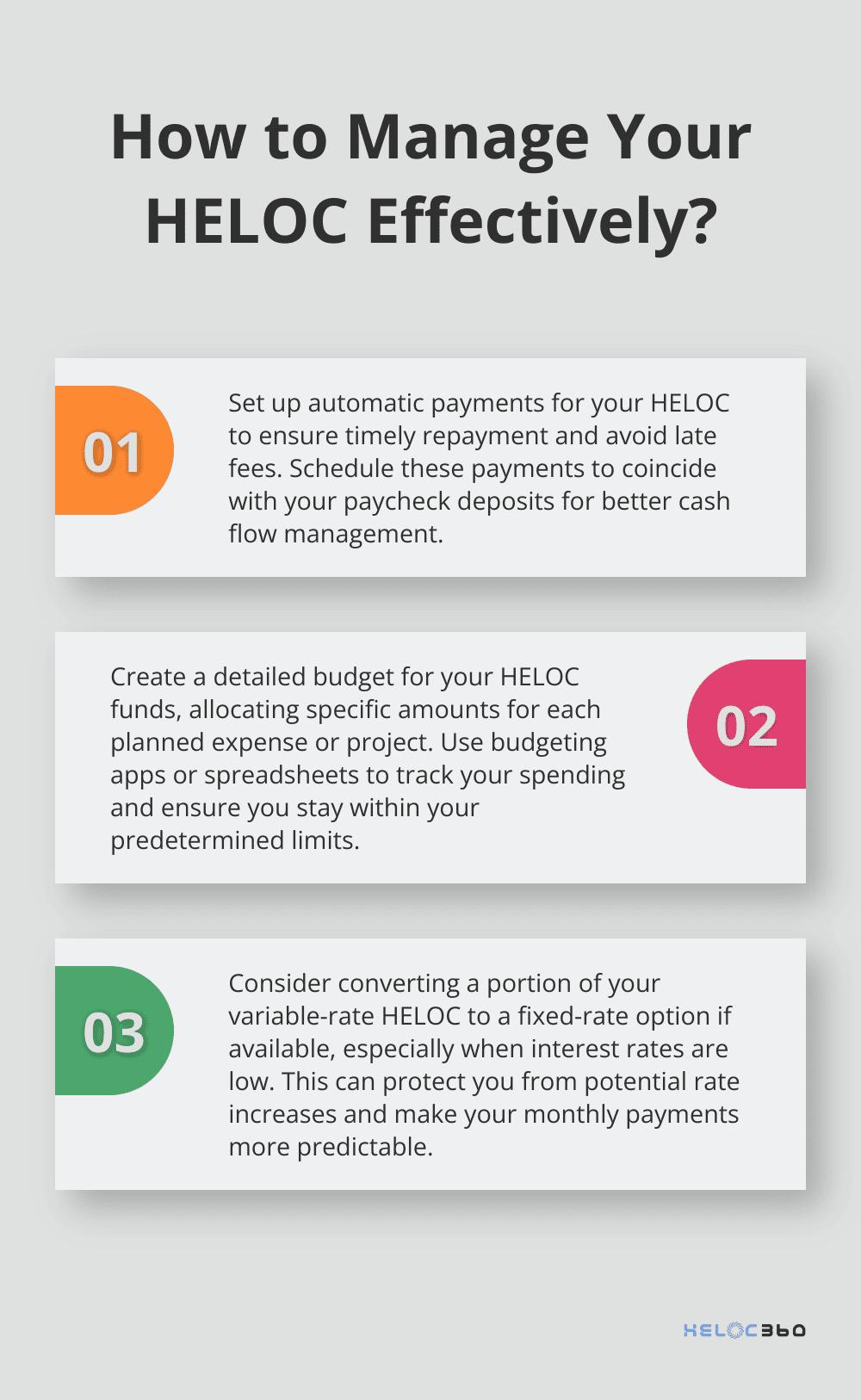

You must weigh your financial goals and circumstances when choosing between a HELOC lump sum and a line of credit HELOC. A HELOC lump sum provides immediate access to large funds, ideal for significant one-time expenses with known costs. Line of credit HELOCs offer greater flexibility, allowing you to borrow as needed and pay interest only on the amount used.

Your decision should factor in the nature of your expenses, your comfort with variable interest rates, and your ability to manage credit responsibly. We at HELOC360 understand that navigating home equity can be complex. Our platform simplifies the process and provides expert guidance tailored to your unique situation.

Our full-circle solutions help you unlock your home equity’s potential, whether for major renovations, debt consolidation, or financial flexibility. We connect you with lenders that fit your specific needs (empowering you to make informed decisions about your financial future). Your home equity can become a powerful tool for building the future you envision with the right approach and guidance.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.